Retail Sales in New Zealand increased 2.70% in the Q1 2015 over the Q4 2014. The real retail sales surged in the Q1 boosted majorly by the premium consumers took pleasure in falling fuel prices.

Sustainable growth in Retail aggregate: New Zealand retailers had a bumper March quarter. The value of spending rose 1.7% which translated into a 2.7% lift in inflation adjusted terms which was the highest quarterly growth in real spending since late 2003.

What drives retail business: Like in the history we noticed that the much larger Rugby World Cup in late 2011 produced a real retail sales growth peak at 1.9%. Now similarly the key drivers for this effect are massive demand for NZD seen as it armored by the Cricket World Cup organized jointly in Aussie and Kiwis soil and the strong tourist seasons. In addition to that there was a predominantly a strong lift in accommodation spending.

Technical and Derivatives Watch:

Well..! It would be very delightful that we traced out the early bullish swings on Kiwi dollar a few days ago while almost all G10 currencies except JPY trading with NZD.

What was cooking with this story has been explained above in brief.

For now, we continue to remain with our technical standpoint as positive convergence on RSI (14) in line with price curve which has been acting as per our expectation, to substantiate this blue line crossover seen on fast stochastic exactly below 20 levels which would certainly indicate an oversold situation on daily chart. However, this has to be confirmed with the weekly chart. Even though we reckon a bullish standpoint on this pair, it is advisable to look in for better dips for cheaper entry points.

Glimpse on Derivatives Instruments:

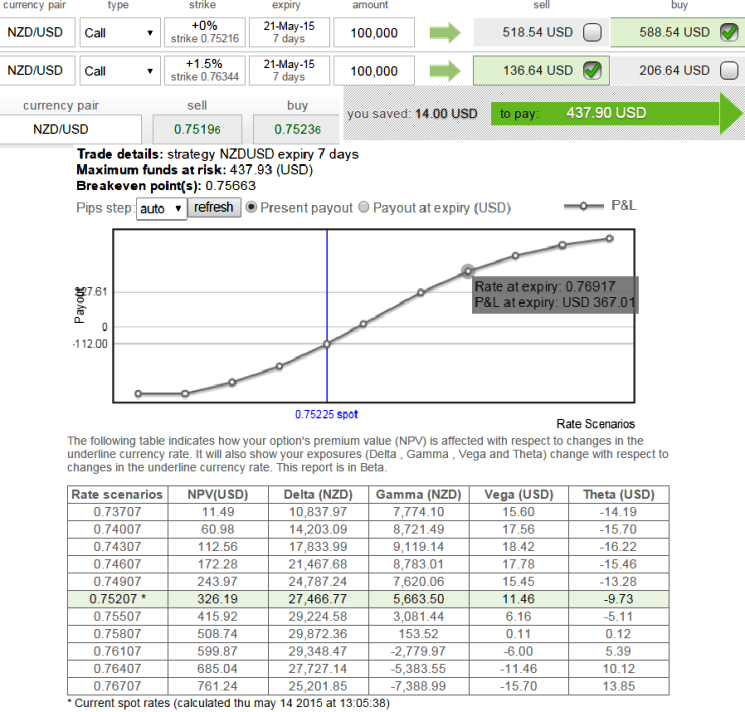

Option Strategy: "Bull call spread" (NZDUSD)

Overview: Bullish

From our last recommendation we tend to append more bullish views on NZD to our portfolios. Correlating both above technical and fundamental stances we were somehow able to perceive an early signs of trend reversal. Now with this confirmed trend reversal pattern we recommend risky speculators who follow active strategy to buy Bull Call Spreads.

This is quite simple to construct this position by buying a call option and selling another call with a higher strike price with the same expiration date for a net premium payable.

This is worth using a Bull Call Spread over a long call when the cost of the long call is too high and the underlying currency is expected to move higher.

Credit from short call reduces the cost of long call.

The chart explains this strategy on NZDUSD pair with different payoffs at different exchange rate intervals.

NZ Q1 retail sales number stumps G10 currencies

Thursday, May 14, 2015 8:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings