We at FxWirePro have advocated put ratio back spread as an optimal hedging vehicle when the underlying spot FX of NZDUSD has been oscillating between 0.7175 and 0.7395 levels, the positive risk sentiment offset by a stronger USD. The USD index is up 0.7% on the day, at the highest level since January.

Well, we captured puzzling swings at the right time about a fortnight ago. It was trading at the spot reference: 0.7292 on 21st March that is where we at FxWirePro has advocated below-stated options strategy.

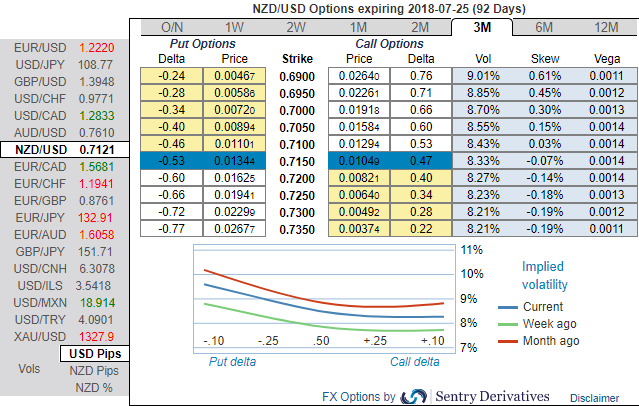

Bids on 3m skews have come in quite worthy, as they signaled the hedging interests for bearish risks, Contemplating this OTC indication and NZDUSD’s consolidation phase, accordingly we had recommended diagonal put ratio back spreads in order to participate in any abrupt upswings in the consolidation phase and anticipated downside risks.

For now, writing 3m (1%) in the money put with positive theta snaps decisive rallies, you could easily make out short legs on ITM puts would go worthless considering time decay advantage.

It was explicitly stated in our earlier write-up as well, we now reiterate that “Theta shorts are recommended in this strategy because, Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.”

Simultaneously, we uphold 2 lots of longs in 3m 1% OTM puts, the structure could be constructed either at net debit.

Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.69 by mid-year which is in line with the above-stated positively skewed IVs.

Moreover, the 6m skews are targeting towards OTM put strikes at 0.67 (refer above nutshell).

Hence, on hedging grounds, the option the holder of OTM puts (in Put Ratio Back Spread) still desirable and is deemed to be on upper hand. One can make out from the above pay-off structure that the strategy likely to derive positive cashflows as the underlying pair keeps dipping.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -70 levels (bearish), while hourly USD spot index was at shy above 75 (bullish) while articulating at 06:30 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes