New Zealand’s annual current account deficit widened slightly from $10.2 billion in Q2 to $10.3 billion in Q3. In ratio terms, it was unchanged at 3.3 percent of GDP.

In seasonally adjusted terms, the current account deficit widened $0.3 billion from Q2, led by a widening goods deficit, as exports fell and imports lifted. New Zealand’s net international liability position widened $6 billion from Q2 to $172.8 billion, and widened 1.4 percentage points as a share of GDP to 56.3 percent.

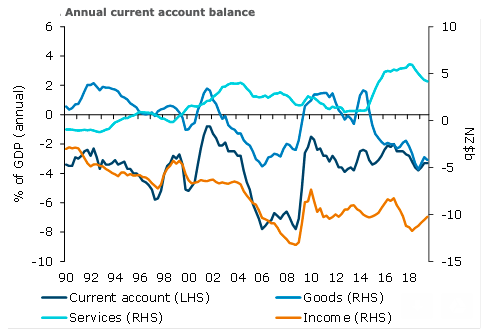

The goods balance posted a deficit of 1.4 percent of GDP, versus a long-run average of +0.7 percent, reflecting still-buoyed demand for imports on the back of robust domestic consumption. The services balance posted a surplus of 1.3 percent of GDP, above its historical average of +0.8 percent, supported by solid growth in tourism exports over the past few years (despite some recent slowing).

And the income deficit of just 3.3 percent of GDP remains narrower than its historical average of 5.1 percent, reflecting low interest rates globally.

The unadjusted goods balance fell from surplus into deficit (from $0.9 billion to -$3.5 billion), as expected, with exports falling and imports lifting. Log and dairy led the decline in goods exports, more than offsetting a lift in the goods terms of trade (if the OTI is anything to go by). Meat prices in particular are benefiting from significant supply disruptions in China’s pork industry.

"The goods deficit is expected to remain broadly stable as a share of GDP. The lower NZD should dampen growth in import volumes, but softer global growth should keep world import prices subdued, providing an offset. Still-elevated net migration and a buoyant household sector will suck in the imports. On the exports side, constrained global dairy supply and demand for pork alternatives in China should keep meat and dairy prices elevated (more than offsetting slightly weaker NZ dairy production this season). But downside risks from weaker global demand remain," ANZ Research commented in its latest report.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022