In nominal terms, NZ's wage inflation hasn't shown any material acceleration since the economy exited recession in 2011. But it's important to put that that apparent weakness in context.

"Wage growth remains modest. The private sector wage rates as measured by the Labour Cost Index were expected to be risen by 1.9% over the past year, up just a touch from last quarter, while the broader QES measure of average hourly earnings growth is expected to have eased back to 2.6%", says Westpac.

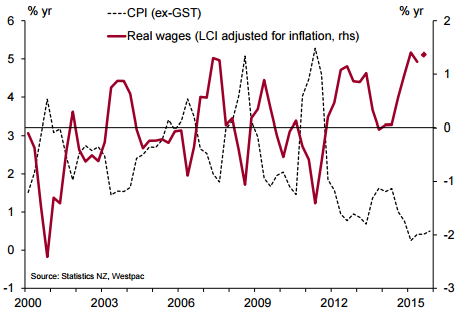

Over the past year, consumer price inflation has fallen to very low levels, meaning that the limited wage increases households have received have actually been stretching further. In fact, the purchasing power of households' wages (often referred to as "real wages") has been growing at its fastest pace since 2007.

"Over the coming year, growth is expected to be seen in real wages moderating to more average levels. Consumer price inflation is expected to lift from current very low levels. At the same time, softening GDP growth and rising unemployment will keep a lid on nominal wages", added Westpac.

NZ's wage growth likely to remain low

Friday, October 30, 2015 5:31 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed