Has winter finally arrived for natural gas?

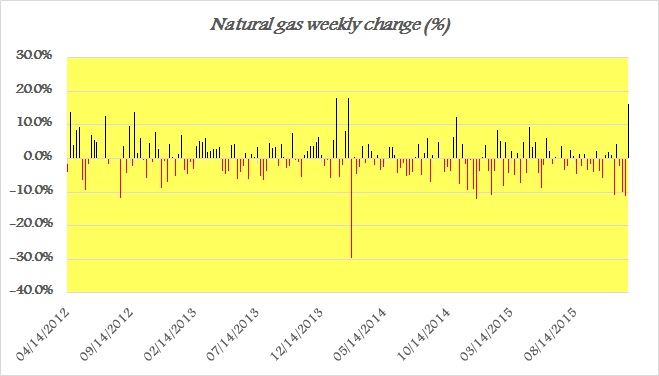

From price rally it suddenly seems so. Natural gas is on its way for its best weekly run, since 2013 winter rush. Severe winter, which was just carrying on rampaging. Price was up 18% twice during last winter and early 2014. This week natural gas is up 16.4% so far.

So is it time to jump on the winter rally?

It is certainly tempting and even could be as good as it looks like, given at least two more months of winter and inventory drawdown still to come.

However, current fundamental do call for caution -

This year inventory in underground storage reached record 4 trillion cubic feet (slightly more) and for the past three weeks drawdown has been 0.163 trillion cubic feet. So if 1 trillion is need to keep up the pressure of flow, which still leaves 2.837 trillion of inventory. And if winter continues till mid -March, we have little more than 10 weeks of winter left.

So it means average drawdown has to be above 250 billion per week. Now at the peak of 2013 winter rush, inventory drawdown has been 0.287 trillion cubic feet.

And about the rally - 2013/14 rally of 18% was far more significant than this week's more than 16% so far. Price is almost 50% less of what was then.

So this week's rally could very well be mix of lower price buying, short covering ahead of holiday week, optimism from US export ban lift and correlation to crude oil.

Natural gas is currently trading at $2.08/mmbtu.

P.S - We are bullish on Natural Gas US in context of convergence with global price, so spread is likely to diminish further. Price in Europe is still high around $6.24/mmbtu.