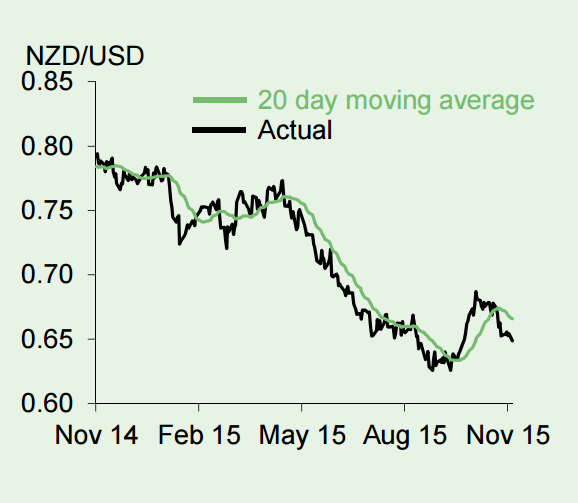

The New Zealand dollar has depreciated over the past month, particularly against the USD, although it still remains above its September low. The RBNZ left interest rates unchanged after its last policy meeting, having previously cut three times in as many months.

However, it also highlighted that further interest cuts were likely, despite concerns that the Auckland housing market is overheating, although latest data show a slowdown in activity. Moreover, with dairy prices, a key export, slumping and domestic economic conditions uncertain, further NZD depreciation is likely in the near term, not only against the USD but also the AUD.

"We see NZD/USD potentially falling below 0.60 by March 2016. Further out, as domestic economic conditions improve, we expect the NZD/USD rate to recover towards 0.70 by end-2016", says Lloyds Bank.

New Zealand dollar Outlook

Wednesday, November 18, 2015 12:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed