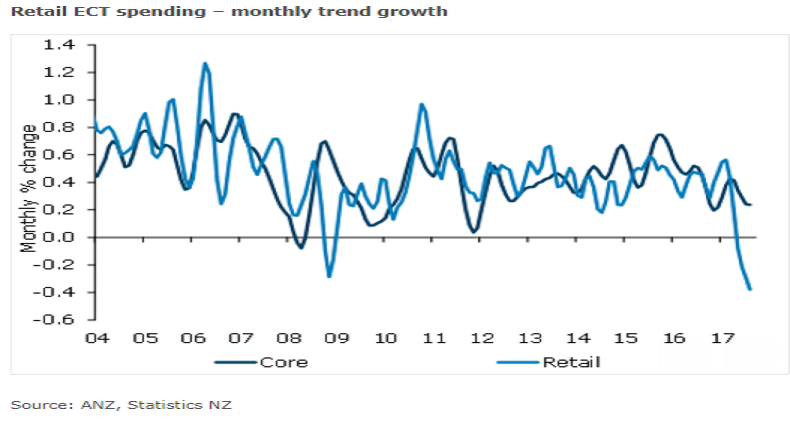

New Zealand’s retail spending on electronic cards fell 0.2 percent m/m in August, which is the fourth consecutive monthly fall. Also, on a 3m/3m basis, spending is now down 0.5 percent, which is the weakest pace of nominal ECT spending growth since 2009.

Earlier petrol price falls have played a big part in this weaker trend, but they cannot be blamed in August. Retail petrol prices are expected to have actually bounced around 5 percent in the month. Fuel retailing did lift 0.4 percent m/m, which is the first increase since February, but it is clearly only a modest lift.

Core spending, which strips out vehicle-related retailing, fell 0.2 percent m/m. And this softness was reasonably broad-based, with dips in durables and hospitality spending (both -0.1 percent m/m) and spending on consumables rising only 0.2 percent m/m.

However, it was another month where spending on services (which is not defined as ‘retail’) outperformed. It rose 0.8 percent m/m, after growth of 1.6 percent m/m in July. On a trend basis, services spending is running at a 1.1 percent m/m pace. This supports our contention that some caution is needed in interpreting the retail ECT figures, as beyond earlier petrol price falls, price competition in the retail sector is likely to be weighing on nominal spending.

"Overall, we suspect the underlying trend in consumer spending is stronger than today’s figures imply. That said, we are keeping a particularly close watch on developments, as history would suggest that weaker housing market activity can quickly spill over into consumer spending trends, and at face value, today’s data provides some evidence that that is possibly occurring," ANZ Research commented in its latest report.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022