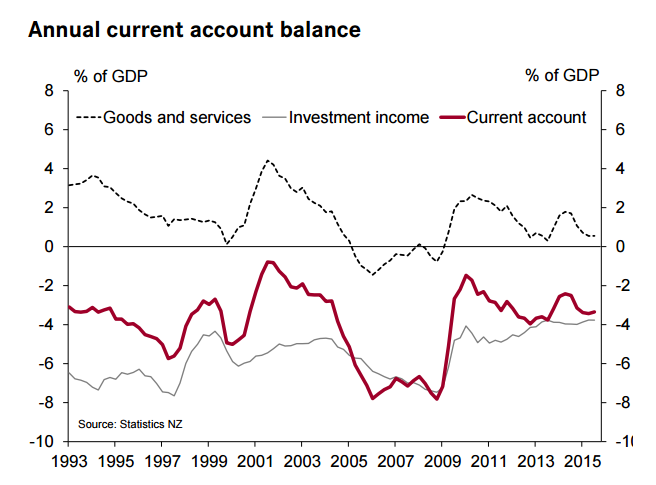

New Zealand's current account deficit narrowed slightly to 3.3% of GDP in the year to September. The result was in line with the market expectations, after accounting for some positive revisions to the June quarter figures that narrowed the annual deficit by 0.1 percentage points.

The current account deficit has remained remarkably steady over the last year, despite the steep fall in prices for dairy exports. More favourable prices for other commodities, growth in export volumes, and most importantly a strong rebound in tourist spending, have provided a substantial offset. While the deficit seen widening over the next year as the full impact of low dairy prices flows through, it is expected to remain well-contained relative to previous economic cycles.

The details of today's release don't provide any further insight into tomorrow's September quarter GDP report. Exports will make a positive contribution to growth, but much of this will come out of inventories. A solid 0.9% increase is expected in GDP, after two quarters of weak growth.

New Zealand’s Q3 current account deficit narrows to 3.3% of GDP

Wednesday, December 16, 2015 2:30 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out