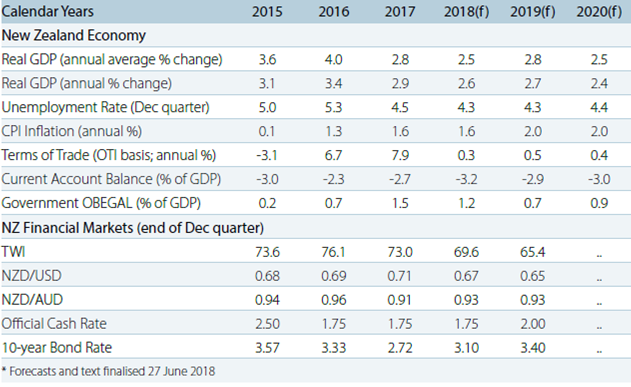

New Zealand’s risks to the domestic inflation profile are skewed to the downside, which could see the Reserve Bank of New Zealand’s (RBNZ) hiking cycle pushed even later. The central bank’s Overnight Cash Rate (OCR) is expected to follow the price direction, according to the latest report from ANZ Research.

This economic cycle has been characterised by strong rates of GDP growth yet stubbornly low inflation. But the economic landscape is expected to be shifting. The economy is going through a softer patch and we expect it will struggle to grow above trend from here.

"On the other hand, cost pressures are increasing and look set to push inflation higher, though likely in a gradual fashion. On balance, and all else equal, we expect inflation will increase and that the OCR will eventually rise: we are pencilling in a hike for November 2019," the report added.

Chinese demand for New Zealand exports continues to hold up, but growth is expected to slow. The ECB remains cautious, but has signalled the unwinding of QE. The Australian housing market is navigating some headwinds and this will likely dampen domestic demand. But other drivers are expected to keep the economy ticking along.

An inactive and cautious RBNZ, together with rising global yields should lead to domestic curve steepening, and a less favourable backdrop for borrowers overall, but it won’t be a smooth ride. The NZD is on the back foot, and further weakness is expected as the implications of a turn in the global liquidity cycle continue to play out. The NZD/AUD remains in a broad range-trading environment.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence