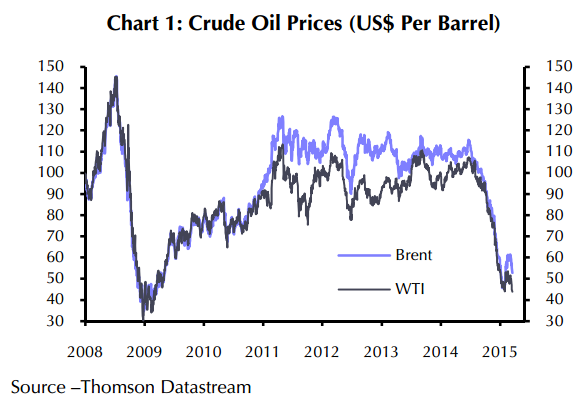

The renewed decline in the price of the traditional US benchmark crude, West Texas Intermediate (WTI), to a six-year low of $43 per barrel, overstates the weakness in global oil prices.

The prices of international benchmarks, including Brent and the OPEC basket, have also fallen this month in dollar terms. Ample global supply amidst weak demand is weighing on prices everywhere

Capital Economics notes in a report on Tuesday:

- Looking ahead, it is plausible that the price of WTI will fall further, at least in the coming weeks. However, the slump in the number of active drilling rigs is already being reflected in slower growth in US production and outright declines should follow soon.

- It is therefore hard to see how current prices can be sustained, let alone more falls given the lack of new investment and bigger cuts in output that would result. A period of even lower prices would also help demand recover more quickly.

- Accordingly, we continue to expect the prices of WTI and Brent to converge again later this year at a higher level. Our end-2015 forecasts for both remain $60 per barrel. These numbers are clearly a stretch given where prices are now. But if anything, the further that prices fall in the near term, the bigger the supply and demand responses are likely to be, and the stronger the eventual recovery.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX