Iron ore fell close to 4% yesterday and now trading comfortably below $50 mark for a metric ton. To compare iron prices are now cheaper than cabbage.

So can it be said that cheaper commodity is good for global growth so no worry?

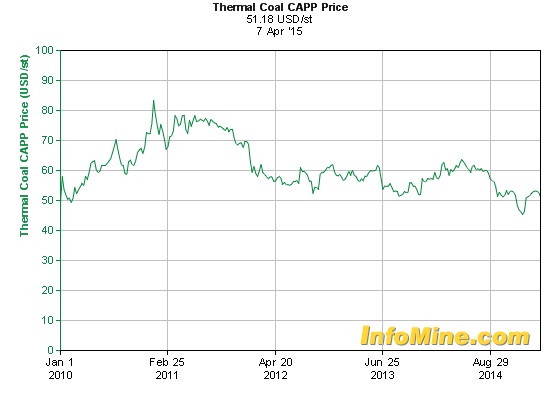

Actually no. It's the growth that is driving the price down. Not only iron ore, prices are declining across raw materials as well as finished goods namely Nickel, Copper, Steel etc. Slowdown in China, is heavily weighing over the metals sector.

Impact -

- Iron Scrap market is facing heavy drop down. Jiangsu Group, biggest scrap consumer in China, cut its buying price by more than 1% this week. Supply remains ample according to spokesperson.

- Domestic iron producers in China are on verge of shutting shops. At this price they just can't compete with larger low cost foreign producers. Watch out for defaults in that sector in China.

- Impact for Australia is grave. Iron ore constitutes of 20% of the country's export and 4% of GDP. Moreover, every $10 fall in iron ore prices below $60, reduces $3.6 billion tax revenue for government.

Australian dollar might keep diving down, unless metals sector and situation in China improves. Aussie is trading at 0.757, down 0.4% today.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?