Barclays notes:

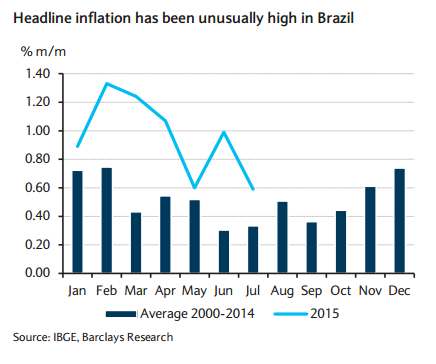

The recent inflation prints in Brazil surprised on the upside, as food prices seasonally experience a decrease between the months of May and July, driving headline inflation lower. This year, however, food prices' monthly increases average 0.97%, according to the IPCA- 15 inflation print released this week. This compares with an average of 0.35% in the same months of last year and 0.19% for that period in 2013. That said, the monthly headline IPCA-15 inflation averaged 0.73% in the past three months, in contrast to 0.41% in the same period in 2014 and 0.30% two years ago. That said, the y/y IPCA-15 released this week moved up to 9.25% from 8.80% in June.

However, the downward resilience in food prices is not the only driver of inflationary pressures. Two essential drivers are long-known to explain the spike in inflation in Brazil: the fiscal adjustment and the exchange rate. If at the beginning of the year the electric energy price adjustments drove regulated prices up to 13% y/y (from 5.7% at the end of 2014), now other adjustments in the fiscal consolidation context, such as lottery prices, are applying upward pressure to inflation releases. The second one is exchange rate weakening. We have the view that the current economic team will let the BRL depreciate in order to absorb the growth recession and reduce the current account deficit, and the reduction in the rollover of the swaps operation supports our view.

Indeed, when looking beyond the effects of the regulated price adjustments that will drive inflation to 8.9% until the end of the year, it is the weaker exchange rate (we forecast the USDBRL to reach 3.35 in 2015 and 3.50 in the next year) that will keep the 2016 IPCA above the midpoint of the target, at 5.6% according to our forecast. If is there any risk, however, it is to the downside, given a central bank that has been more hawkish, its continued tightening of monetary conditions and also a slowdown in the services sector, which could translate into softer services inflation prints in the next six quarters.

No rest for Brazil's inflation, at least for now

Friday, July 24, 2015 1:47 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed