The government's funding need stems from various lending schemes, such as student loans and mortgages for public employees. While the deficit of the day to day running of the government is funded by a transfer from the petroleum fund, these schemes are funded through issuance of government bonds.

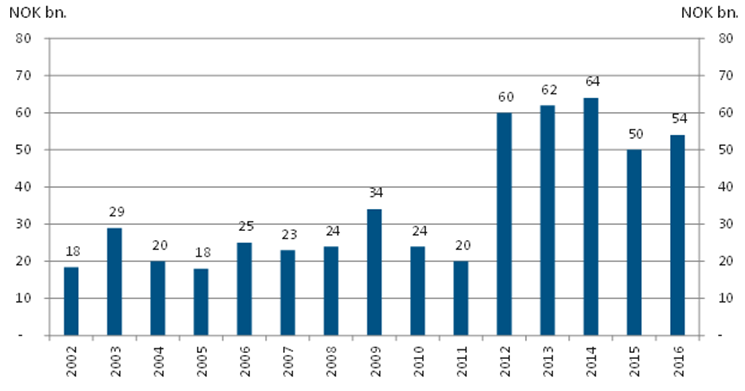

"With a issuance of NOK 54bn the government maintains the relative high issuance volume over the previous years. We had expected a lower issuance volume as the underlying funding need is plummeting. The underlying funding need from the various lending schemes is reduced by 26bn from 2015 to 2016 to 10bn. This is mainly due to an over 20bp drop in net lending to mortgages for public employees", says Nordea Bank.

Despite a lower underlying funding need a transfer from Norges Bank to the government contributes to keeping issuance volume high. The transfer amounts to 14bn. The transfer is an income for the government and will have a positive liquidity effect. To neutralize the liquidity effect of the transfer the same amount of NGBs will be issued, thus adding 14bn to the funding need.

"In addition to lending transactions and the transfer from Norges Bank the government also rolls over maturing government bonds. There is a bond maturing in 2017 and a share of this will be prefunded in 2016. As such the maturity of NGB2017 will add NOK 30bn to the funding need for 2016",added Nordea Bank.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed