The government organizations, popularly known as the national team, comprising of Securities Finance Corporation (SFC), large insurance houses, state owned brokers, fund that holds government's stake in financial institution are finding it that it is not at all easy to tame a rampaging Chinese Bear.

There seems to no buying interest without government intervention. This is a clear setback for Chinese authorities, who are trying to shore up the stock market.

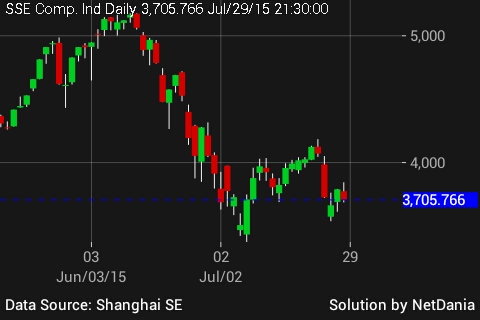

Chinese benchmark stock index, Shanghai Composite today dropped by 2.2%, after two days of gains.

If Chinese government is not sufficient enough even with almost $5 billion, nobody knows what is?

As of now it clearly looks like that investors' confidence is clearly shattered in the domestic front, while foreign investors are clearly staying away from such a rigged market.

Risks are extreme if the stock market continues to drop in spite of government intervention. This will create a clear nationwide panic and sell offs are likely to get worse.

With bringing in the banks, insurance agencies and pension fund to the fray, government has clearly increased the risk, if its put fails to succeed.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings