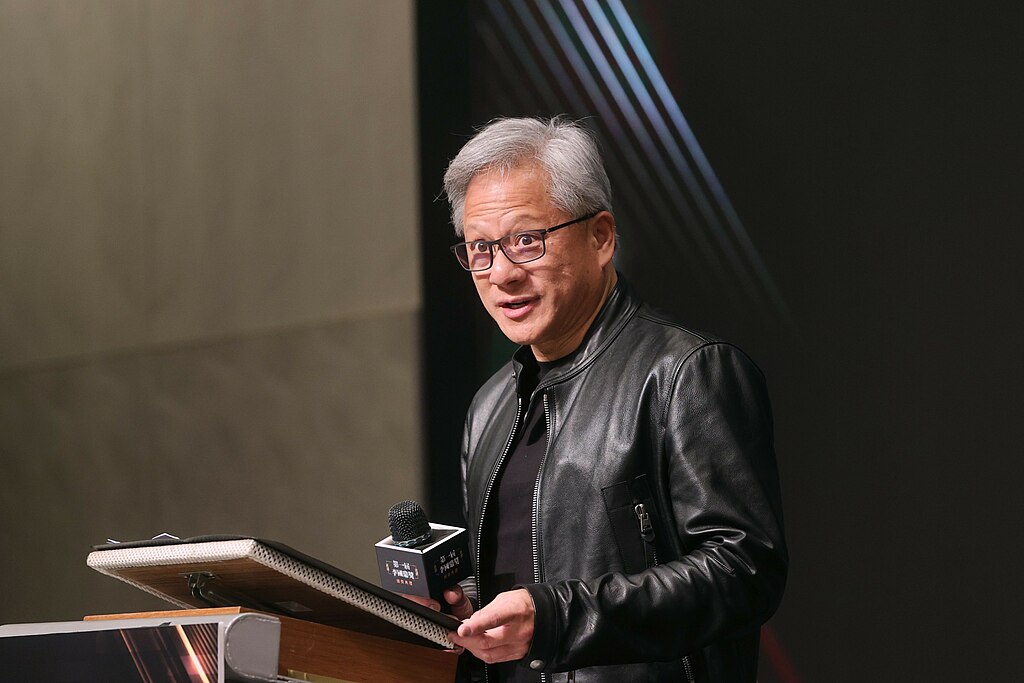

Nvidia CEO Jensen Huang criticized the U.S. government’s export controls on AI chips to China, calling the policy “a failure.” Speaking at Computex 2025 in Taipei, Huang said, “The fundamental assumptions that led to the AI diffusion rule have been proven fundamentally flawed.”

The U.S. restrictions, aimed at curbing China’s access to cutting-edge artificial intelligence chips, have backfired, according to Huang. Rather than stalling progress, the export ban pushed Chinese firms to turn to domestic semiconductor designers like Huawei. The move also accelerated China’s efforts to build a self-reliant chip supply chain, reducing dependence on U.S.-made components.

Huang revealed that Nvidia’s market share in China has plummeted to 50%, down from 95% when President Joe Biden took office. The shift underscores the significant impact of U.S. policies on global chip competition and supply chains.

His comments followed China’s sharp response earlier this week to the latest U.S. guidance warning companies not to use advanced Chinese AI chips, including Huawei’s Ascend processors. Beijing urged Washington to “correct its wrongdoings” and end what it described as “discriminatory” practices, warning of firm countermeasures if U.S. actions continue to harm Chinese interests.

The escalating chip tensions also threaten to undermine recent efforts to stabilize U.S.-China trade relations. A statement from China’s commerce ministry noted that the latest U.S. move violated the spirit of high-level negotiations held in Geneva.

As global tech firms navigate shifting geopolitical dynamics, Huang’s remarks spotlight the unintended consequences of protectionist trade policies, especially in the high-stakes AI and semiconductor sectors. Nvidia remains a leading player in AI chips, but faces growing headwinds in key international markets due to regulatory friction.

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off