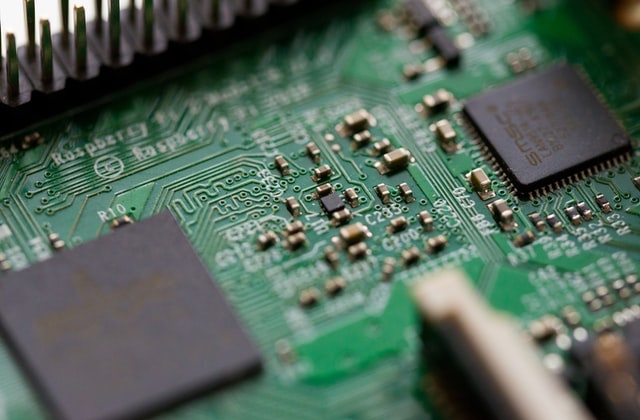

Nvidia (NASDAQ:NVDA) highlighted the rising demand for its chips in China after DeepSeek, a leading Chinese AI firm, showcased its advancements using Nvidia's H800 GPUs. The statement followed Nvidia's shares dropping 17% to $118.58 on concerns that DeepSeek achieved significant progress using fewer Nvidia chips compared to competitors like OpenAI. Shares of rival Advanced Micro Devices (NASDAQ:AMD) also fell, sliding over 6% to $115.01.

DeepSeek utilized approximately 2,000 Nvidia H800 chips, compliant with U.S. export regulations introduced in 2022. These restrictions aimed to curb China's development of supercomputers for AI and nuclear capabilities but have not significantly slowed Chinese AI advancements. According to Jimmy Goodrich, a technology expert at RAND Corp, China's AI firms, including DeepSeek, have long been building their expertise with existing Nvidia-powered supercomputers.

Nvidia emphasized that DeepSeek's demand for inference processing underscores the importance of its GPUs and networking solutions. Inference, the process of serving AI-generated responses to users, requires substantial computational power. Nvidia's H20 chip, designed for compliance with export rules, remains a critical tool for this process. Goodrich noted that the H20 is likely the best chip globally for inference, despite its limited AI training capabilities under export restrictions.

DeepSeek's ongoing progress demonstrates the resilience of Chinese AI innovation, even under U.S. export controls. Nvidia, however, sees a bright future for its chips in meeting the growing demands of Chinese firms, highlighting their reliance on advanced GPU technology for both AI training and inference workloads. As demand for AI solutions surges, Nvidia's products are expected to remain integral to global AI development.

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million