Those who expect the underlying currency to make a large move higher from here onwards, then this strategy can be established as follows,

Purchase more number of calls and sell fewer calls of a lower strike usually in a ratio of 2:1.

The lower strike short calls finances the purchase of the greater number of long calls and the position is entered for no cost or a net credit.

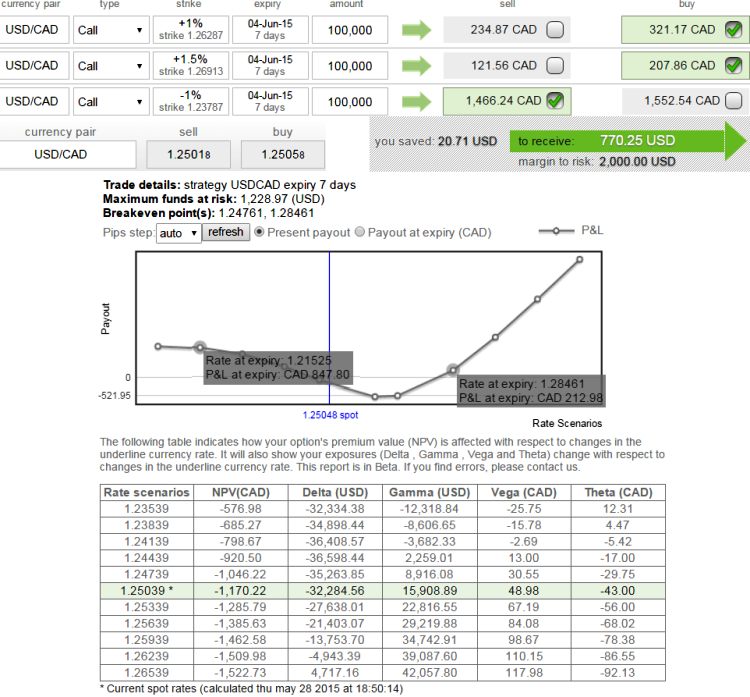

As shown in the figure, for 2 OTM calls can be bought at 528.71 Canadian dollars which would be financed by short call. But use near month near month contract for shorting side.

The USD has to make substantial move on the upside for the gains in long calls to overcome the losses in the short calls as the maximum loss is at the long strike.

Using mid month contract on long side gives underlying currency a longer time so as to make a substantial up move.

In this trade, the maximum loss is to the extent of Long Strike - Short Strike - credit received.

But the maximum gain on the other hand would be unlimited on the upside and limited on the downside to the net credit received.

OTM calls on CRBS of USD/CAD offer optimal cost of hedging

Thursday, May 28, 2015 1:37 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings