International Energy Agency (IEA), which is the energy watchdog of the developed markets, has been warning against supply crunches that may lead to spikes and volatilities in oil price by the end of the decade. Now, they are backing up their claims with reserve discoveries data.

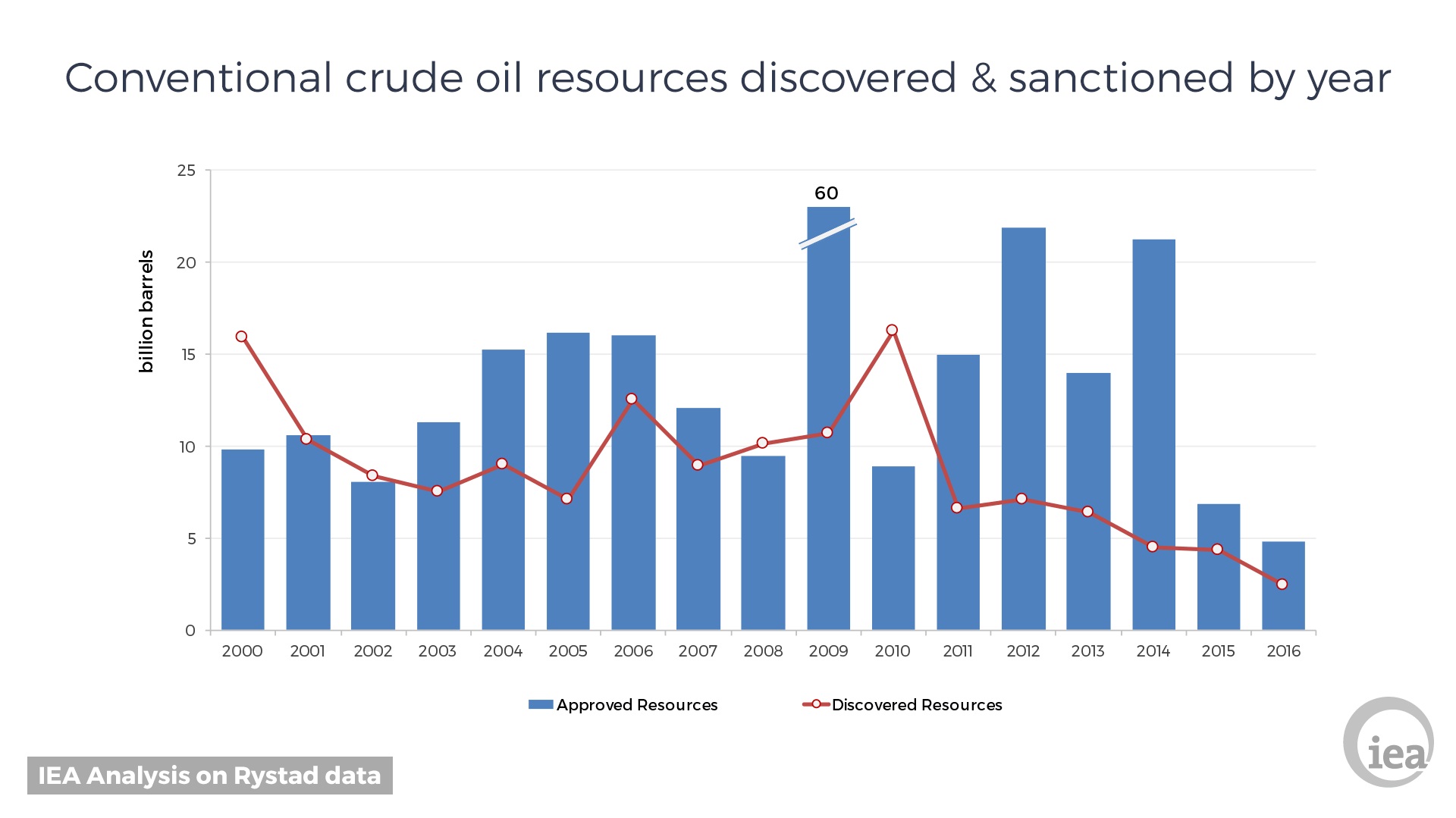

A report and date released by IEA suggest that as companies cut their traditional investments and spending, global oil discoveries and projects sanctioned declined to the lowest in more than 70 years in 2016. Oil discoveries declined to 2.4 billion barrels in 2016, compared with an average of 9 billion barrels per year over the past 15 years and the volume of conventional resources sanctioned for development fell to 4.7 billion barrels in 2016, 30 percent lower than the previous year as the number of projects that received a final investment decision dropped to the lowest level since the 1940s.

However, the slump in the conventional oil sector contrasts with the resilience of the US shale industry to attract investments. There, investment rebounded sharply and output rose, on the back of production costs being reduced by 50 percent since the oil crash of 2014. According to IEA, the growth in US shale production has become a fundamental factor in balancing low activity in the conventional oil industry.

With oil price staying at a low level, IEA expects the exploration spending to decline for the third consecutive year.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX