The price of crude oil has reached the highest level in four years this week, as the price of Brent reached $86.5 per barrel. North American benchmark WTI is currently trading $10 per barrel discount to Brent. Despite consecutive monthly increases in production from OPEC, Russia, and the United States, the geopolitical tension focusing Iran is pushing prices higher.

While the market is more focused on Iran due to looming U.S. sanctions in November, which will specifically target Iran’s oil exports and its banking sector, Venezuela is acting like a bigger bullish factor for the oil market, which is largely going unnoticed.

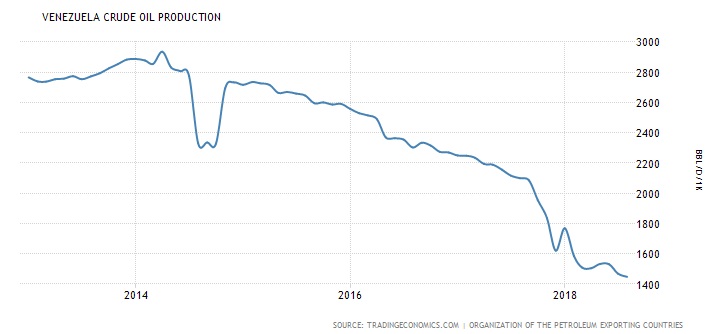

Due to political unrest amid an economic crisis, the production has significantly gone down in Venezuela, over the course of the past couple of years and the rout is far from over. Back in 2014, the country was producing around 2.9 million barrels of crude oil per day, and at the beginning of 2016, Venezuela was producing around 2.6 million. But over the past two years, the production has declined by 50 percent with production declining to just around 1.3 million barrels per day in September this year.

Analysts are now suggesting that the production could drop by as much as 0.3 million barrels in October and reach just 1 million barrels per day.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX