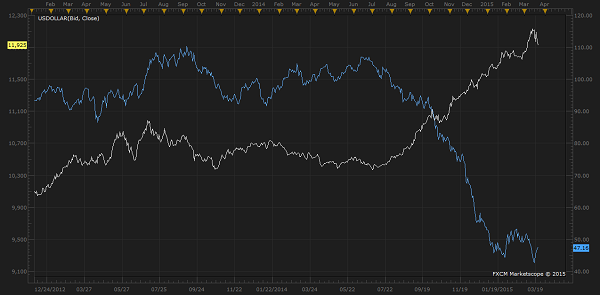

The chart above shows two contrasting securities, WTI crude oil and Dow jones FXCM US dollar Index. WTI crude is trading at 47.61, up 0.3% today. Dollar index is trading at 96.7, down 0.25% today.

- As can be seen, FXCM dollar index that is value of US dollar against a basket of currencies rose sharply since June 2014. Oil price started falling at the same time.

- Similarly oil price is rallying from lows, up more than 10% since last week, after FOMC participants slashed the rate forecast along with economic projections.

This move is not unusual given that oil is quotes in dollar, however impact of this negative correlation may not hold well over longer term for US economy and oil dependent emerging markets.

- These record easing by Central banks have high possibilities to spark significant inflation in future.

- Demand trends and economic improvements are being seen all across the developed economies.

Given the policy divergence and growth outlook, dollar might still have long run left.

- However there will be a time, when policies will converge from maximum point of difference. So dollar might lose its shine at that point and if higher oil price accompanies results would be more alarming.

- US have tons of domestic oil and slowly moving towards renewables so real pain then will be bore by those oil dependent emerging market countries who delays to make necessary adjustments.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?