Talks have been flying since crude oil price started collapsing in June 2014 and finally tumbled by more than 50% in 2015, that lower oil price will be causing havoc for oil exporting economies and will be beneficial for oil importing ones.

Though it can generally be considered to be true, however it should be taken with pinch of salt.

Oil importing economies' banks might have large exposure to oil exporting ones which make them vulnerable to crude shock.

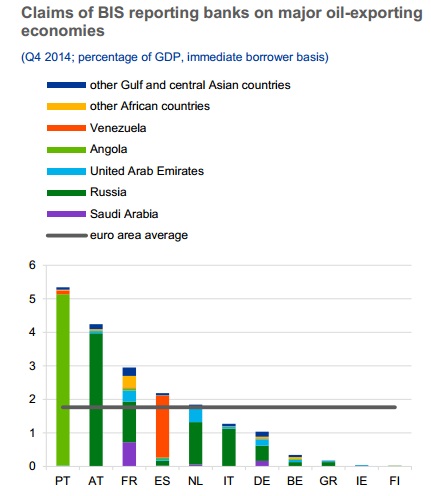

The chart displays European banks exposure to different oil exporting economies as percentage of GDP.

- Overall European banks' exposure to oil exporting economies are low, less than 2% of GDP. However cross border exposure varies significantly.

- Portugal's banks have high exposure to Angola, more than 5% of GDP, which stands as highest in Euro zone.

- Many economies' banks like Germany, Italy, Netherlands, Spain, and France have exposure to Russia, however Austrian exposure stands out at 4% of GDP.

- Spain which has overall low exposure, marginally higher than 2%, however 95% of its exposure is concentrated towards Venezuela, a country which is going through political turmoil and currency crisis.

Similarly global banks which have excessive exposure towards oil exporting economies, face higher risk on those exposure.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate