European Central bank will be deciding on monetary policy based on its assessment of entire European Monetary Union (EMU) which comprises of 19 different countries. Similarly Euro will take its direction based on economic and monetary conditions for entire EMU.

These different countries however experiencing different level of growth and inflation, in turn making individual countries assets namely bonds to do the necessary adjustment.

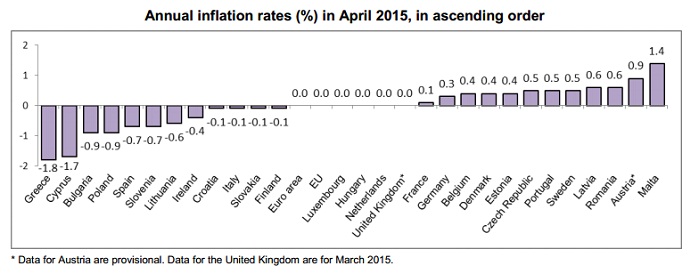

- Today headline CPI for EMU remained flat at zero percent in April compared to a year ago.

- Negative inflation was observed in 9 EMU countries with lowest in Greece at -1.8%, followed by Cyprus (-1.7%), Spain (-0.7%), Slovenia (-0.7%), Lithuania (-0.6%), Ireland (-0.4%), Italy (-0.1%), Slovakia (-0.1%) and Finland (-0.1%).

- Inflation remained flat in 2 EMU countries, Luxembourg and Netherlands.

- Inflation was positive in 8 EMU countries. Highest was observed in Malta (1.4%), followed by Austria (0.9%), Latvia (0.6%), Portugal (0.5%), Estonia (0.4%), Belgium (0.4%), Germany (0.3%) and France (0.1%).

If inflation is to be key driver of bond yields in the coming years expect yield curve steepening in EMU countries experiencing higher rates of inflation, whereas short term yields will remain well anchored as long as ECB to keep deposit rates in negative territory.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings