Producer prices rose 0.5% m/m in May, stronger than consensus (0.4%) forecasts. The rise in headline PPI was driven by a 5.9% m/m increase in energy prices. Core PPI (ex-food and energy) rose a more modest 0.1% m/m (consensus: 0.1%). On a y/y basis, headline PPI fell 1.1%, a slight improvement from April (-1.3%), as past falls in energy prices continue to weigh on the y/y change. Core PPI inflation rose 0.6% (from 0.8%). The goods component of PPI rose 1.3% m/m, boosted by rising energy and food prices. Services inflation was unchanged on the month.

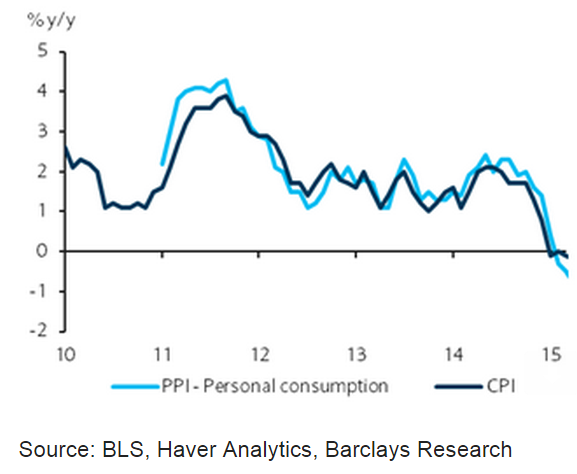

Headline personal consumption PPI rose a robust 0.6% m/m, with the core measure showing a solid 0.2% gain. On a y/y basis, personal consumption PPI declined 0.5%. Core personal goods prices increased 0.5% m/m, bringing the y/y rate up to 2.4%.

"This report showed a broad-based recovery in prices across categories, following last month's disappointing data. We expect PPI inflation to continue to firm, as we believe the negative contributions from the energy component are largely behind us, and we think that the effects of past dollar appreciation on domestic inflation are beginning to wane and should diminish further in the third and fourth quarters." notes Barclays

Personal consumption PPI suggests a moderation in downward pressures for US CPI

Friday, June 12, 2015 2:26 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX