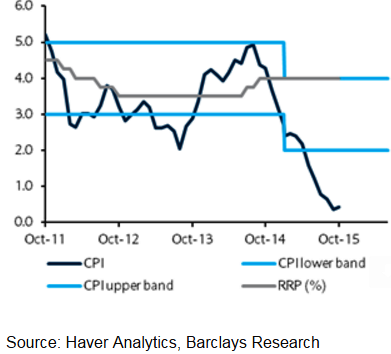

BSP Governor says that Philippines inflation rate settles down within 0.1%-0.9% range after the September ease, which is its slowest pace in two decades. October inflation rate was softer, which was expected by the central bank because of slippage in power and gasoline prices, which moderated the impact of Typhoon Koppu on supply of food.

BSP also explained that the energy inflation is expected to pull the headline figure. The bank added the stability of last month's food prices, however they were expected to see an increase over the months to come.

It expected the inflation to remain benign due to the base effects, which are likely to affect data, also the inflation is expected to remain under the trend till year-end. It will observe of price developments to ensure its primary mandate of price stability conducive to balanced and sustainable economic growth is achieved.

With poor weather conditions and weak agricultural production, headline inflation was manageable, but core is low. The central bank might keep its rates on hold next week, and be on sidelines through 2015.

"Even with low inflation and slower-than-expected H1 growth, BSP appears comfortable with its policy stance, emphasizing that growth and inflation risks stem largely from poor weather and the uncertain global backdrop", says Barclays.

BSP cut its 2015 CPI forecast at its last meeting and now expects inflation to average 1.6% this year, but the central bank raised its 2016 inflation projection to 2.6%. According to BSP, the biggest risk to both growth and inflation likely comes from poor weather.

"Slower core inflation is expected and also a more modest increase in energy costs in 2016, as oil prices are likely to rise only gradually. We believe the medium-term risks to inflation centre on El Niño and its potential impact on agricultural prices", added Barclays.

Philippines inflation likely to be below trend until year end

Thursday, November 5, 2015 5:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022