Report released by the Australian Bureau of Statistics showed on Thursday that Australia’s unemployment rate declined unexpectedly to its lowest level in two-and-a-half years in March. Australian unemployment rate dropped to a seasonally adjusted rate of 5.7% in March, down from the 5.8% recorded in February, beating expectations for an increase to 5.9%. Australian employment change increased to a seasonally adjusted figure of 260.1K, a massive leap from the 0.3K recorded in February.

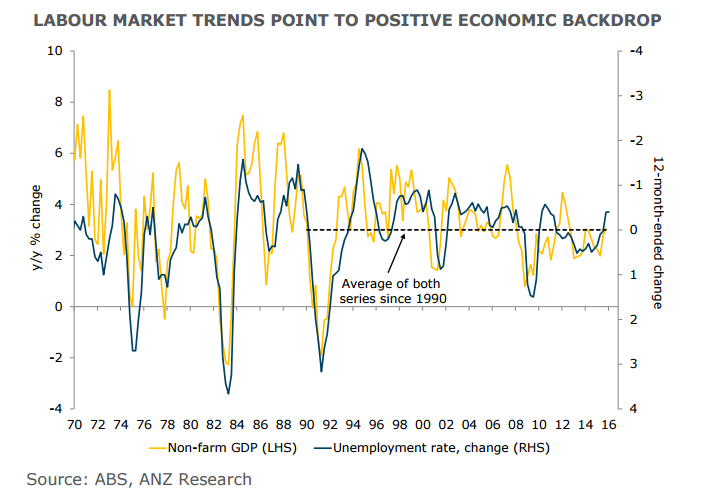

Upbeat data reflected a lift in business confidence and signaling the central bank is unlikely to ease policy in the near-term. Data corroborates the positive trends seen in the major business surveys, albeit at a less robust pace than last year. Underlying trends in employment and unemployment continue to reflect stronger growth.

At its policy meeting today the Reserve Bank of Australia as widely expected left the official interest rate unchanged at 2%. The Board judged that there were reasonable prospects for continued growth in the economy, with inflation close to target, thus justifying its decision that the current setting of monetary policy remained appropriate. RBA’s statement at its April policy meeting made it clear that a rate cut will ultimately be driven by the labor market and inflation outcomes.

Today's data suggests that Australia's underlying labour market conditions remain solid even if not as strong as in 2015. This will likely keep the RBA on the sidelines even if inflation prints ‘low’. Traders are pricing in just a 16 percent chance of a rate cut next month, less than half the level of bets two days ago.

“There’s clearly a trend now of a stronger labor market than many analysts were allowing for, which is consistent with other positive economic indicators,” said Shane Oliver, head of investment strategy in Sydney at AMP Capital Investors Ltd. “Any hope of an imminent rate cut is well and truly out the window on the back of these figures.” he added.

The Aussie inched higher against its US counterpart following the release of unexpectedly strong Australian employment data. AUD/USD was trading at 0.7712 at 1130 GMT.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary