One thing is certain that European Central Bank (ECB) has once again brought Euro zone economy back from abyss and this time around economy has rebounded with a bang.

With cheap money flowing from ECB at €60 billion/month (probably a bit more in summer) all European assets are expected to turn the corner.

- While bond market provides little yield to jump in for, investments in European real estate can return much higher. If one can do away with two issues, illiquid nature of the asset and lump sum fund requirement, then it is the best thing to be in.

- Investors with smaller chunks of money can choose investment in REITs (Real Estate Investment Trust) or in shares of real estate developers.

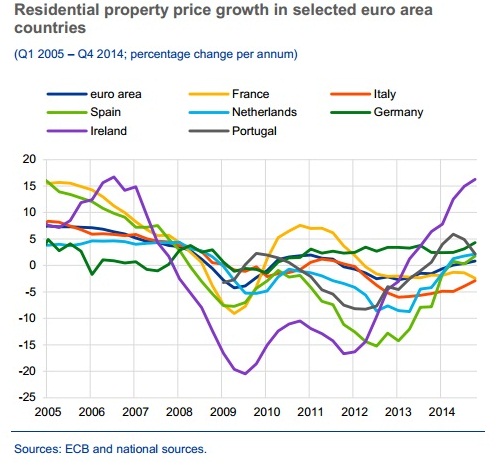

As shown in the chart, European Real Estate is turning the corner.

Why real estate is attractive?

- With growth returning to Euro zone economies, employment will move up, which in turn will increase demand for houses for stay as well as rent. With low interest rates on mortgages demand is likely to move up faster.

- Businesses are bullish on economic prospects, which will result in higher investments and expansions. That will essentially give rise to higher demand for commercial properties. Years of depression has already ravaged real estate prices in Euro area, which makes things even better.

It may sound too simple and too good to be true, but property prices in Ireland which stands out among Euro zone growing at 15% per annum portray what might happen in the real estate market when growth and confidence returns.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings