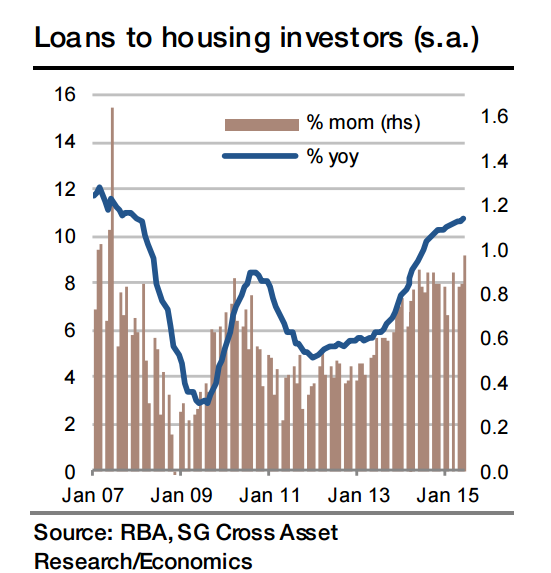

Two key developments are expected to shape the monthly credit data for July. One is the beginning of a moderation in credit growth to housing investors as a result of regulatory pressure. Banks have raised mortgage rates to such investors, and will also be more restrictive in their lending policy given warnings by the regulator (APRA) that banks which exceed the 10% guidance on maximum growth in this segment will be subject to special attention and potentially be forced to make additional provisions. This may begin to affect the data in July or in any case soon, after a particularly strong expansion in June (12.3% mom annualised). Two, some revival in credit growth is expected to businesses which has been weak for the last four months.

"In light of recent legislation encouraging small investment activity through tax breaks, a pick-up in credit demand ought to materialise - and we are in any case rather optimistic about non-resource investment activity", says Societe Generale.

As to the mainstay of credit growth, lending to owner-occupiers for house purchasing, steady growth of 5 -6% is expected in annualised terms. In short, easy monetary policy is expected to remain effective in supporting credit growth.

Regulatory pressure beginning to slow Australian housing investor credit

Monday, August 31, 2015 12:52 AM UTC

Editor's Picks

- Market Data

Most Popular

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny

ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed