Since mid-last year, property prices in China is going through steady rise in prices. According to latest data overall property prices are up 3.6% in February. This price rise has been steady since mid of last year and China enthusiasts are getting excited once more. Many are calling that expansionary policies pursued by People’s Bank of China (PBoC) along with targeted policies such as reduction in down payment for house purchase in lower tiered cities, slashing taxes on properties.

However, key driver behind rise in property prices may not be policies and buying homes, rather speculative forces once more, at least erratic rise in prices suggests so.

- According to latest report, house prices in Shenzhen area was up 72% from a year back. It was up more than 3% on monthly basis. Similar was seen in Beijing and Shanghai, where prices were up more than 40% and 25% respectively. Per square meter space in Shenzhen Rea Estate now costs about 50,000 Yuan.

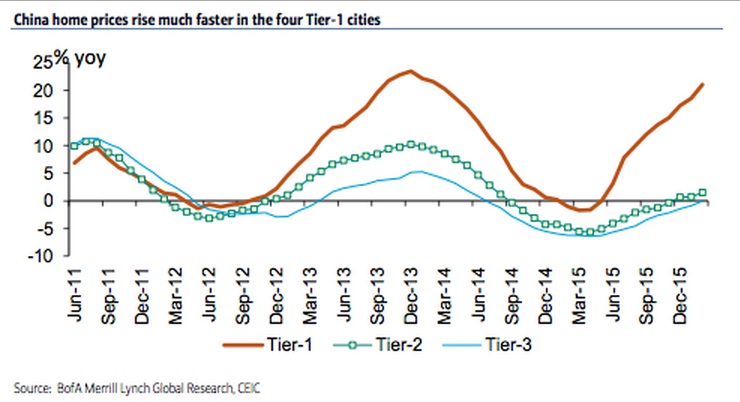

- Compared to the above figure, prices were up just 1.5% in Tier-II cities and prices actually dropped by -0.1% in Tier-III/IV cities. Latest chart from Bank of America Merrill Lynch (BofAML) shows the disparity in the housing market.

- Latest figures show, inventory absorption time, has come down steadily from their peak in fourth quarter of 2014 and it is further going down for Tier-I and Tier-II cities but it is increasing for Tier-III/IV cities.

China, despite being world’s second largest economy, large chunk of its people still lives in rural and semi-urban areas.

- These Tier – III/IV cities are where biggest chunk, more than 50% of property transactions take place. These are also the cities, where inventory levels are still on the higher side.

So, despite some overall recovery, prominent trend is that prices are over speeding in Tier-I cities like Shenzhen.

Recent stock market crash, corporate bond rally and rapid rise in house price inflation in few areas are strongly suggesting that large chunk of money looking to be invested.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why you may not be able to get on the housing ladder or buy a bigger home in 2024

Why you may not be able to get on the housing ladder or buy a bigger home in 2024  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  UK Housing Market Slows Amid Tax Hike Concerns

UK Housing Market Slows Amid Tax Hike Concerns  Replacing stamp duty with a land tax could save home buyers big money. Here’s how

Replacing stamp duty with a land tax could save home buyers big money. Here’s how  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength