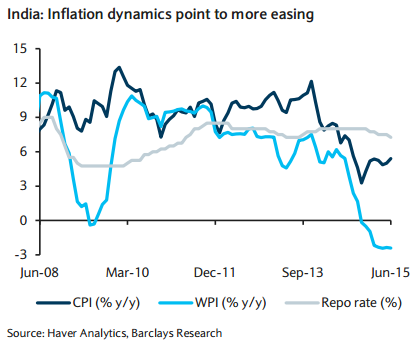

The Reserve Bank of India (RBI) held its key policy rates unchanged this week, but gave hints of further easing in upcoming meetings. With the bank's monetary policy stance turning softer, the central bank is on course to deliver another 25bp repo rate cut in H2 2015, unless incoming data - for example, the monsoon - is significantly poorer than expected. On the balance of risks, a rate cut is expected at the RBI's next meeting at end-September.

"While the RBI has rightly reiterated that its policy action will remain data dependent, a 25bp repo rate cut in September is our baseline scenario," says Barclays.

The RBI noted that "...Significant uncertainty will be resolved in the coming months, including the likely persistence of recent inflationary pressures, the full monsoon outturn, as well as possible Federal Reserve actions. As the Reserve Bank awaits greater transmission of its front-loaded past actions, it will monitor developments for emerging room for more accommodation." Indeed, while the RBI has lowered the repo rate this year (75bp during H1 2015), it has of late, emphasised three key risks: 1) below-normal monsoon rains; 2) uncertainties around crude oil prices; and 3) volatility in the external environment.

Further, given India's generally sound macroeconomic parameters, the impact of any Fed liftoff on India will likely be relatively limited. The initial impact of a potential Fed hike - if indeed it takes place in mid-September - on INR assets should also be visible before the RBI's end-September policy meeting. Accordingly, a 25bp repo rate cut is expected in September, unless the monsoon disappoints during September-October.

Reserve Bank of India: On hold for now, but on course for further easing

Friday, August 7, 2015 1:08 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022