Research survey suggests that investors consider renewed crisis in Eurozone has higher threat than a rate hike by Federal Reserve this year.

- Fitch polled more than 350 investors at events in Hong Kong and Singapore show that they remain extremely worries about over current haggling between Greece and its creditors.

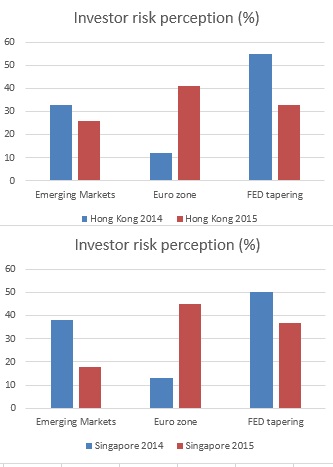

- Last year at the same event, they considered FED tapering as highest risk posed.

- Last year just between 12-13% of the surveys though Euro zone as of higher risk, this year that percentage soared to 41-45%.

- Investors' concern over emerging market has abated somewhat this year. Last year 33% of investors in Hong Kong, 38% in Singapore though emerging markets as higher threat to global recovery compared to 26% in Hong Kong and 18% in Singapore in 2015.

- 33% investors in Hong Kong and 35% in Singapore still consider FED hike to be of higher risk to global recovery this year.

Cautious mood among investors suggest that they are not complacent about Euro zone in spite of Euro's drifting in recent trade. Any fallout in negotiation might turn out to be a devastating scenario.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary