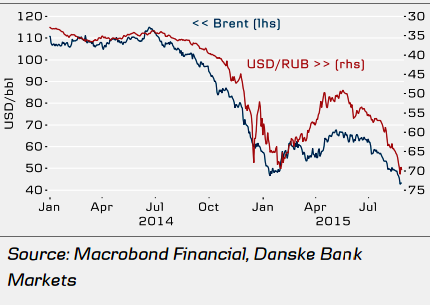

The Russian rouble hit its year high on 24 August, weakening to 70.89 against the USD and to 82.37 against the EUR as the oil price fell to its lowest level of the year on the same day. The sell-off in commodities accelerated on tumbling stock markets in China, which spread further globally, hurting emerging markets and commodity currencies the most.

As the Brent price has lost 18.8% over the past 30 days, the Russian currency has clearly been the worst performer in the emerging market universe, losing 15.2% in spot return against the USD over the period.

It has been the fastest deterioration in the rouble since the currency crisis in December 2014, the one that led to a record FX run and emergency rate hikes. In addition, significant outstanding FX debt repayments at that time created extra pressure on the rouble amid the introduction of financial sector sanctions.

"A totally new environment for the central bank accelerating the transition to a free floating regime as significant FX intervention was wasted FX reserves", says Danske Bank.

Rouble weakens on oil and Chinese woes

Thursday, August 27, 2015 4:14 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022