The dip in Russia's fixed investments and industrial production was less (-5.6% y/y and -3.7% y/y, respectively) than expected while the demand side continues to disappoint on the back of the purchase power crash.

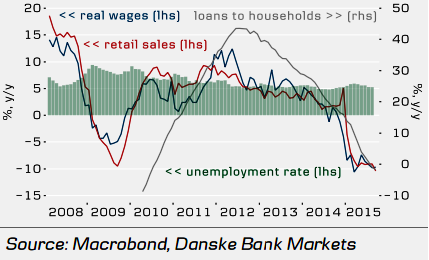

As inflation remained high, real wages growth (-9.7% y/y) shrank the most in 16 years, pushing retail sales to their lowest level since 1998 (-10.4% y/y).

"The real wages are expected to shrink further in 2016 as the future budget will see imminent cuts on the expenditure side. The unemployment rate fell to 5.2% in September from 5.3% a month earlier, continuing to support demand", says Danske Bank.

Russian consumers have suffered the most during the current recession. Purchase power fell to its weakest in years as 2015 average inflation is at 15.5% y/y, pushed up by the devalued rouble and limited supply due to Russia's counter measures.

Russian consumer turmoil continues

Wednesday, October 21, 2015 5:30 AM UTC

Editor's Picks

- Market Data

Most Popular

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns