South Africa was hit hard by PBOC devaluation last week. The move came as a further blow to an already battered South Africa's economy, plagued by electricity shortages, labour unrest, mining-sector decline and a weak manufacturing sector. USD/ZAR hit fresh 15-year highs of 12.87 mid-week. Against the EUR, the decline has been somewhat more contained as ECB QE has put downward pressure on the EUR.

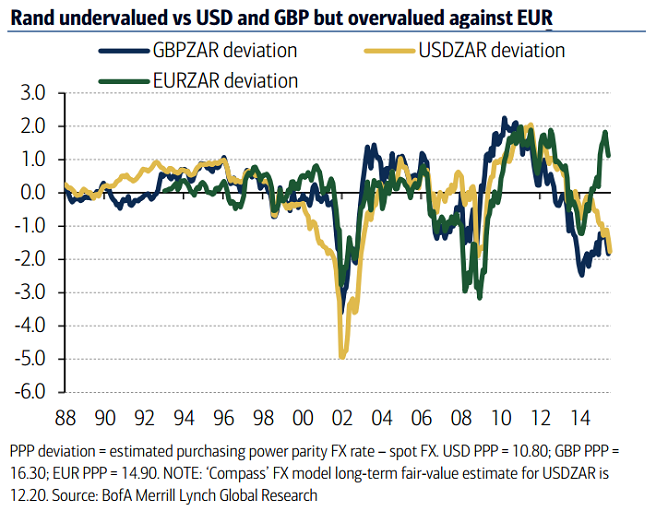

On a number of metrics, the Rand is looking undervalued. That said, it remains vulnerable to near-term overshooting given concerns over China's growth trajectory, as well as the uncertainty created by the PBOC's devaluation of CNY and the implied negative near-term impact for commodity prices and terms-of-trade.

The devaluation of the yuan, coupled with a broader slowdown of the Chinese economy, is likely to weaken demand for the commodities that have spearheaded Africa's booming trade with Beijing. Chinese manufacturers can now probably compete even more ruthlessly against African producers as Beijing's exports become cheaper.

While there is a risk that further sustained weakness in Rand could see the SARB respond by hiking again in the near-term, analysts differ in the view that Rand weakness is most likely to see the SARB use the currency as a tool by initially accommodating Rand weakness and react to any second-round effects into inflation expectations further down the line.

"The SARB will likely use the "cover" of above-target inflation in early 2016 to push through two 25bp hikes in January and May. However, this is likely to be followed by a pause over 2H16. With signs of a likely pick up in core inflation moving into 2017, we look for a further two 25bp hikes to a peak of 7.00% by mid-2017", said BoFA Merrill Lynch in a research note to its clients.

South Africa's relatively low external vulnerabilities lowers the risk of a significant rate hike surprise from the SARB when the currency weakens. The SARB is expected to remain committed to some degree of rate normalization over time in order to raise nominal and real policy rates.

South Africa's rand was on a slightly firmer footing against the dollar on Monday. At 0649 GMT ZAR traded at 12.8150 per dollar, a tad up from Friday's close at 12.8260. Government bonds were also flat, with the yield for the 2026 benchmark unchanged at 8.175 percent.

SARB likely to accommodate further Rand weakness

Monday, August 17, 2015 10:21 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?