CHF rates against Euro may seem to add heavy downward pressure on recent Swiss national bank's (SNB) announcement. As per SNB President Jordan's pronouncements that there was a review on pipeline which sight deposit accounts were eligible for exemption, the SNB has now done its evaluation of exemptions and has significantly reduced the clusters of sight deposit account holders that are exempt from negative interest. Negative interests in particularly will now also apply to the sight deposit accounts held at the SNB by enterprises associated with the Confederation.

Only around 160 bln Swiss francs were charged with negative interest out of 450 bln Swiss francs in sight deposits with SNB at this time, while the remaining part was exempted. This has provided a strong incentive to all (domestic) banks to fully utilize the amount up to their exemption threshold. The pronouncement of fewer full exemptions from the negative interest rate rule is seen as an additional step to prevent circumvention of the negative rate.

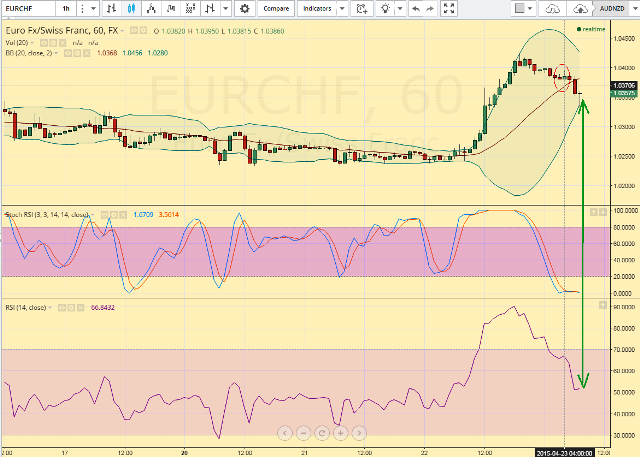

We would expect to see some downward pressure on CHF exchange rates. In today's trading sessions the price curve will be smoothened as short term profit bookings are expected. But later, Euro could make further gains against the Franc as markets are yet to digest the SNB's decision.

The above price expectations are confirmed on hourly, 4 hourly and daily EUR/CHF charts as we could figure out a clear hammer formed on falling swings on hourly chart which is a corrective indication for some breathing space for those who have shorted futures early to find an appropriate support to bounce back.

SNB’s moderated policy measure helps domestic banks

Thursday, April 23, 2015 7:49 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?