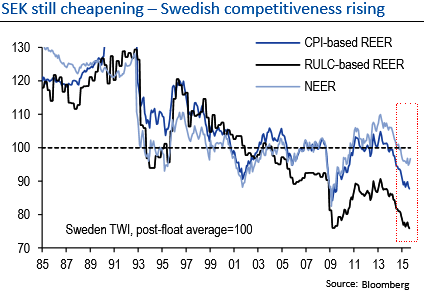

SEK has transacted sturdily through November and early December months, gaining against almost all G10 currencies. But took a U turn again in New Year series, further gains from here onwards would be more challenging, however, with EUR/SEK back in the 9.35-9.45 zones that the Riksbank has previously shown great discomfort with (not least with March's intra-meeting rate cut).

Despite SEK strength, the central bank stood pat to leave rates unchanged at the December 15 meeting and also left its forward guidance unchanged, the profile implying a material risk of another cut in early-2016.

Governor Ingves also stressed that -0.35% should not be seen as a floor for policy rates. Looking forward, we think the Riksbank will remain sensitive to exchange rate movements in early-2016. In large part this reflects the importance of the spring wage round, when around two thirds of the labour force will settle wage deals, many of them lasting for three years.

Low headline inflation readings through the negotiations would run the risk of employees locking into low wage growth for a prolonged period, making it more difficult for the Riksbank to hit its medium-term inflation target of 2%. For this reason, and given the Riksbank's apparent preference for keeping EUR/SEK above 9.20, our bias is for a softer SEK into Q1.

Owing to crude prices, NOK continues to trade ailing prices lower, with EUR/NOK retesting the year's high above 9.74 and NOK/SEK fell to a 23-year low. The significant easing of policy through the exchange rate was probably a key reason for Norges Bank leaving rates on hold at its December 17 announcement, despite a further 15% fall in crude prices since the previous meeting.

Going forward, Norges Bank's guidance is signaling another rate cut, and with rates still 0.75% above the zero bound, it clearly has more scope to deliver than other central banks in Europe. Domestic data are certainly no impediment, with onshore GDP barely positive in Q2 and Q3, and the high level of core inflation (3.1% y/y) largely due to import prices. While this risk remains and until we are confident crude prices have formed a base, we continue to see the risks to the upside for EUR/NOK.

Scandis FX space still looks vulnerable in H1 2016

Thursday, January 28, 2016 12:00 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate