We are sensing Canadian dollar over USD creating fruitful returns as the CAD's weakness since Q4 2014 attracts the BoC some comfort in the face of low oil prices and recent strength will likely be seen as toting up risks to the growth/inflation outlook. The market is looking for Canada GDP for February to decline 0.1% mom on Thursday, a weaker outcome is likely to invite fresh CAD shorts.

On the contrary, a more productive outlook from the BoC at its April meeting has grounded the market to price out rate cuts and led to significant CAD strength in recent days. However, central bank's governor Poloz testimony in front of the House finance on Tuesday and Senate banking on Thursday will give an indication of how the central bank views recent market moves. On the flip side, we think CAD weakness has given the BoC some time to evaluate its policy stance in the face of low oil prices. As such, we would expect further CAD gains to invite BoC dovishness.

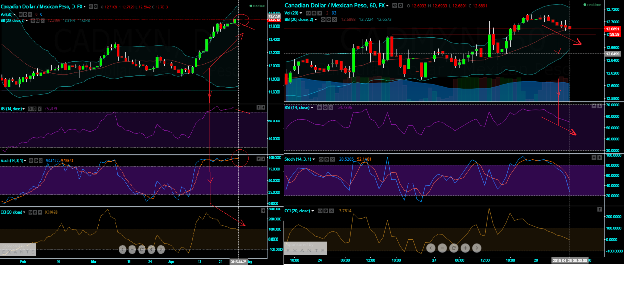

Trade idea and Technicals watch:We see a clear bearish trend on CADMXN currency cross on both intraday and daily chart. An early signal of downswings are confirmed by a declining convergence of RSI (14) at around 80 levels, divergence of CCI (20) on daily chart and crossover on fast stochastic above 80 levels. We could now figure out a dangerous doji may occur on daily chart which is an element of suspicion of massive slump. Hence, one can short futures of this pair at 12.6780 levels both for intraday and STBT purposes (sell today buy back tomorrow).

Short CAD futures, opportunities pour on weaker GDP data

Tuesday, April 28, 2015 9:18 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary