The MXN has lost over 20% in less than a year partly due to the lower oil price, and its impact on various areas fiscal, exports, investment and partly due to the volatility infinancial markets arising from such issues as the timing and extent of Fed tightening, the rising probability of Grexit and its implications, the fall in China's equity market andongoing and possible central bank actions in response to these developments and developments in the domestic economy.

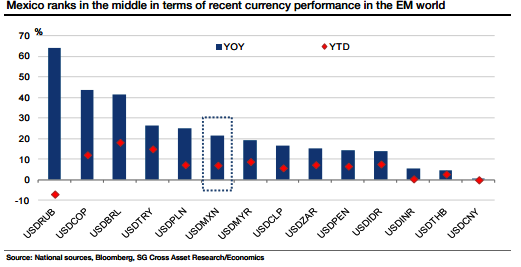

MXN is found be the worst performing EM currency since the last Fed meeting and expects further depreciation in the near term. Over the past year, however, the extent of MXN depreciation has not been that considerable when seen in the context of the overall EM currency space.

However, the fact that Mexico's largest trading partner, the US has seen good growth over the past year and is close to achieving full employment has not been of much benefit to the MXN so far.

Also, Mexico's trade and financial openness, recent reforms, relatively better growth outlook and sound monetary policy achievements also seem to have been largely ignored, says Societe Generale.

Significant MXN depreciation, but within the range seen by other EM currencies

Wednesday, July 8, 2015 3:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed