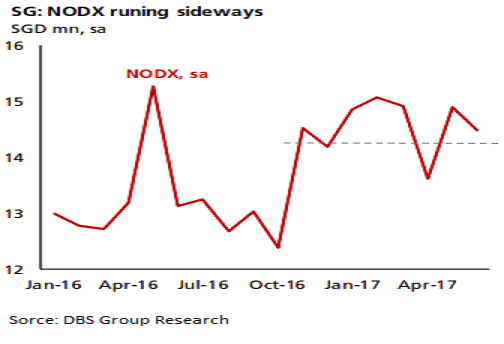

Singapore’s export performance will likely hold up. Non-oil domestic export (NODX) sales for July due tomorrow will likely register an expansion of 9.1 percent y/y. While this is up from 8.2 percent in the previous month, it’s nothing more than just a sideway moves in the data series.

Net off some base effect and possible uptick from exports of pharmaceutical products and the headline NODX growth will probably be where it was previously. The rally in electronics export is losing steam. Though a contraction is not expected in the near term, the PMIs, semiconductor billings, and shipments data are hinting of some side-way moves in the electronics exports.

Separately, the pharmaceutical industry had a rough patch over the past three months and is due for a rebound. An uptick in this export segment will be enough to push the headline figure slightly higher compared to the previous month, DBS Bank reported.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices