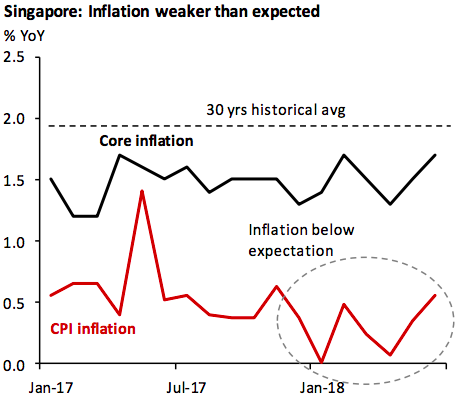

Singapore’s consumer price inflation forecast for this year has been lowered to 0.7 percent, from previous estimates of 1.0 percent, according to the latest research report from DBS Economics & Strategy.

While recent pick-up in inflation readings have been in line with DBS’ long-held view, average inflation for the first half of this year (0.3 percent y/y) has been lower than previously anticipated. There are signs that the subsequent increases in the coming months could be gradual.

The persistent decline has been largely driven by weak rentals on an existing supply glut and a moderation in the inflow of foreigners. While the decline shows some tentative signs of easing, the government’s recent and new property market cooling measures will weigh down on the property market and subsequently, on rental and accommodation CPI inflation as well.

"We continue to expect the core inflation series to remain range-bound between 1.5-2 percent for the rest of the year. On this account, there is little impetus for the Monetary Authority of Singapore (MAS) to shift away from its current gradual appreciation stance, particularly given the risk to growth arising from the external headwinds. We are also keeping to our inflation forecast of 1.8 percent in 2019," the report commented.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient