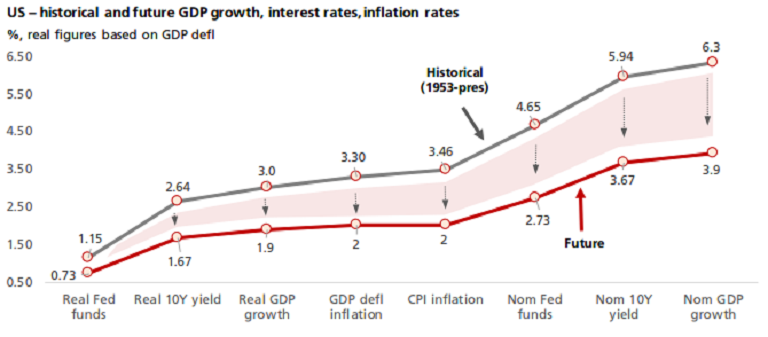

A slower rate of economic growth is expected to prevail in the United States for the next decade, while inflation is also likely to remain low too. Structural changes in growth and inflation mean structural changes in interest rates as well. Rates will be lower and spreads narrower.

Growth in gross domestic product (GDP) and inflation are both lower than they have been historically and will probably remain so for the next decade, perhaps longer. These structural changes mean 'neutral' interest rates; in simple terms, those that prevail through the ups and downs of the cycle, should be lower than in the past too, DBS reported.

Since 1953, real GDP growth has averaged 3.0 percent. Real 10-year yields have averaged 88 percent of that or 2.64 percent. But baby boomers are retiring and working-age population growth has fallen like a rock, down to 0.4 percent per year.

"We reckon that means potential GDP growth, again, that which would be expected to prevail through the cycle, has probably fallen to 1.9 percent per year, a full 1.1 percentage points lower than before," DBS commented in the report.

Meanwhile, Ten-year Treasury yields have risen to 1.82 percent as markets increasingly price in higher inflation and the likelihood of a December Fed hike; that is a rise of nearly 50 basis points in four months.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX