US unemployment rate stands at 5.5%, hovering close to level considered normal by Economists and US Federal Reserve. Average of initial jobless claims have reached multi decade low.

- Still not all the employment indicators have reached close to normal or even pre- crisis level of 2008. Payroll gains and unemployment rate varies widely among industries and size of companies.

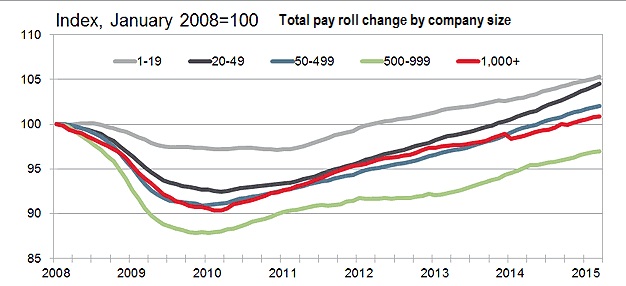

As shown in the chart, payroll gains at large companies with employee base larger than 1000, contributed not only less to pay roll gains, is yet to reach pre crisis level. Most of the gains are driven by companies with fewer than 50 employees.

This divergence is partially due to lacklustre demand globally as large companies tend to operate on economies of scale.

- Moreover jobs added by professional and business services remain solid, jobs in construction and manufacturing remains weaker then pre-crisis level.

Manufacturing lag is partially due to automation, whereas housing and mortgage sector remain somewhat weaker than prior.

US Federal Reserve would very likely deliver at least one rate hike this year, however pace of hike would be very gradual as FED would wait for recovery and job gains to speed up in the following sector.

So even with a rate hike delivered dollar's rise would not be one way ride. Dollar index is trading at 94.85, down -0.30% today so far.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings