Saudi Arabia is pumping crude at record pace in its bid to protect its market share, especially in Asia, and to push high cost producers out of the oil market.

However, its strategy at one hand to pump crude at record pace and maintain a currency peg at 3.75 (approx.) against Dollar is taking its toll on country's foreign exchange reserve, which has declined at record pace on record.

- Though trade balance has shrunk considerably, Saudi Arabia is still running positive balance. In first quarter of 2015, trade balance shrank to Saudi Arabia Real (SAR) 5.47 billion from more than SAR 200 billion last year.

- In first quarter of 2015, Saudi Arabia's capital account recorded deficit of more than $15 billion, lowest since financial crisis and first negative balance in more than 4 years.

With all these, Saudi's peg with Dollar is taking toll over its FX reserve.

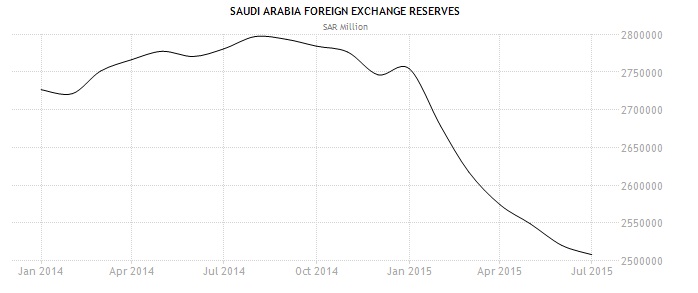

- Saudi FX reserve decline to SAR 2.5 trillion in July, down from around SAR 2.77 trillion back in January. That's around 9.8% decline in reserve in just about 6 months.

Saudi Arabia still has enough reserves ($668.7 billion) to defend the peg, however longer the oil price stays down, higher will be the risks.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand