Societe Generale notes:

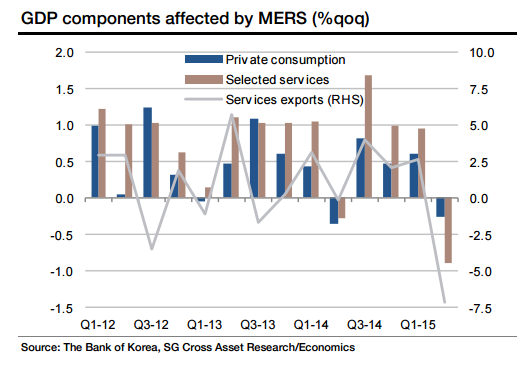

South Korea's Q2 GDP data clearly shows that the weakness in GDP growth was mostly driven by MERS concerns that should be temporary. In the breakdown by expenditure, we watched the contraction of private consumption (qoq growth fell from 0.6% in Q1 to -0.3% in Q2) and services exports (from 2.6% to -7.2%, due to the decline in incoming foreign tourists).

In the breakdown by industry, specific service sectors that should be related to MERS showed relatively significant contractions: wholesale/retail sales and hotel/restaurant businesses (by 0.5%), transportation (by 1.3%) and healthcare and welfare (by 1.7%, people refrained from visiting hospitals for the fear of contagion).

Meanwhile, we have found that a few key growth drivers were pretty strong in Q2. Both manufacturing production and merchandise exports, traditional drivers of Korea's exportoriented growth, have shown healthy recovery from the weakness since Q3 2014: Q2 growth in manufacturing production and merchandise exports is 0.8% and 1.1%, respectively. The financial sector was strong (3.7% in Q1, 2.3% in Q2), which is evidence of a credit boom and proves that the BoK's monetary easing policy has been effective. Sustained growth in construction investment (1.7%) after the volatile movements in Q4 2014 and Q1 2015 due to the "fiscal cliff" is also worthwhile noting.

Though the Korean government announced the effective "termination" of the MERS outbreak on 28 July, it may take a few more months until economic activity normalizes from the impacts of MERS. So we cannot rule out a further downgrade in the economic outlook in October, considering that the BoK's current economic outlook is pretty optimistic regarding H2 growth (1.1% qoq per quarter). Nevertheless, we believe that the BoK will remain on hold, even if it lowers the GDP forecast again in October due to weaker-thanexpected Q3 growth, as long as disappointing GDP reflects lingering impacts from MERS and the key growth drivers of exports/manufacturing and financial sectors remain intact.

South Korea: Weak GDP driven by MERS concerns, while a few key growth drivers were strong

Tuesday, July 28, 2015 1:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX