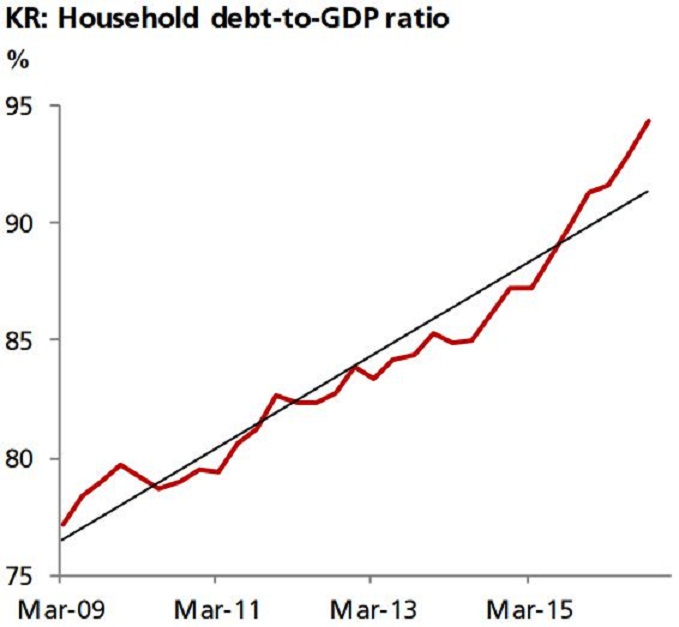

South Korean household debt expanded 12.4 percent in December, as compared to 11.9 percent a year earlier. This growth in household loans was majorly supported by the increase in mortgage and rebound in the non-mortgage segment. Also, as a percentage of nominal GDP, household loans expanded by about 2.5 percentage points last year.

Moreover, it is worth noting that the household debts from both banking and non-banking financial institutions have risen in 2016, causing higher household debt to GDP ratio. We foresee that it is likely to reach cross 95 percent mark in the near-term.

On the other hand, the latest financial statistics showed that bank loan growth decelerated to 6.6 percent y/y in December, the 14th consecutive month of slowdown. In the whole year of 2016, bank loans grew an average of 8.5 percent, a slightly slower rate compared to 9.6 percent in 2015. Loans to large companies declined -2.0 percent, a reflective of the restructuring process in overcapacity sectors especially shipping and ship-building, reported DBS Group Research.

Notwithstanding the government’s recent implementation of property market cooling measures, excess liquidity and record-low interest rates mean that the incentives for lending/borrowing should remain high. Liquidity aggregate in financial institutions grew about 8 percent in 2016, well outpacing the nominal GDP growth of 4 percent. Real interest rate (benchmark repo rate minus headline CPI) has fallen to about zero in the past four months. But economic and household income growth is expected to remain modest this year, they added.

Looking ahead, the Bank of Korea may find some hurdles to tighten monetary policy until domestic and global economy recover. Fiscal stimulus and structural reforms from the new government will build path for the BoK to tighten monetary policy and then focus on rising household debt.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock