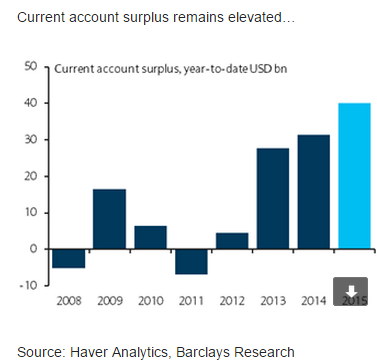

South Korea's current account surplus widened to USD8.7bn in May (April: USD8.1bn; March: USD10.4bn), broadly in line with the forecast (USD8.5bn). The slightly bigger surplus was driven by a substantial improvement in the primary income account, following dividend payments in April; alongside a smaller improvement in the services balance, this helped offset a narrowing in the goods balance surplus, which was driven by a jump in imports.

With the cumulative year-to-date surplus now standing at USD40.2bn, the current account surplus is expected to reach USD94.3bn in 2015 (BoK: USD96bn; 2014: USD89.2bn) and USD84.4bn in 2016 (BoK: USD82bn). However, with activity remaining soft and the marginal benefit of any further rate cuts diminishing, the emphasis is likely to be on other growth levers - such as fiscal stimulus (supplementary budget) and an engineering of a weaker KRW to support growth.

Indeed, on 26 June, the government announced what believed to be the first round of measures to weaken the currency. All told, it is believed that the measures will generate an additional USD20bn in potential outflows through the capital account this year, in a bid to offset the estimated USD96bn current account surplus. This adds to recent calls for Korean sovereign wealth funds to investment more funds abroad.

The current account surplus is likely to remain elevated in the coming months, even as the oil import bill could creep higher on a monthly basis. However, the extended period of soft activity indicators including IP and exports underscores the need for a weaker KRW bias.

Ultimately, the next significant policy move is expected to be fiscal, not monetary. Indeed, on 25 June, the government unveiled a fiscal stimulus package of KRW15trn, including a supplementary budget, which will be submitted to National Assembly by early July. That said, the actual spending is only likely to reach the economy in Q4.

Barclays notes:

- We estimate that a package of KRW15trn (excluding the loan guarantees that may inflate the size of the package but contain little stimulus) could lift growth by 0.5pp, although the impact will be felt mainly in 2016.

- We think there is still a risk of further easing if the release of Q2 GDP undershoots the BoK's July revised forecast or if there is no sign of a turnaround in activity indicators.