Standard & Poor's global sovereign ratings outlook published in Jan showed that the number of investment grade sovereign ratings ('BBB- or above) amongst the 131 sovereigns rated by S&P globally, is just over 53%, the lowest level ever. Similarly, the number of 'AAA' rated sovereigns has now declined to 13, from 19 in December 2010, however the 'AAA' share in the total rated sovereigns is off its all-time low of 9% recorded in mid-2015.

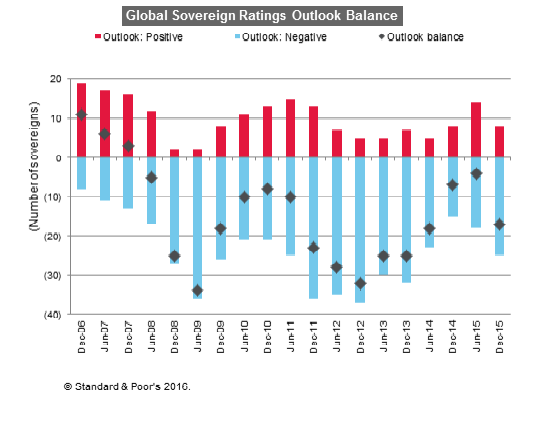

Since mid-2008 sovereign downgrades have generally outnumbered upgrades. The eroding credit quality of rated sovereigns goes some way to explain the mild decline seen in the unweighted average sovereign rating. Over the past five years, S&P has lowered two sovereign ratings per month on average, but raised only one. This pattern was continued in 2015, despite a mild uptick in upgrades.

The trend is also likely to continue into 2016, with more downgrades likely for the year. Negative outlooks have outnumbered positive outlooks since early 2008. The second half of 2015 has seen a reversal of the gradually improving trend in the outlook balance that had begun in 2013. On Dec. 31, 2015, the 25 negative outlooks outnumbered eight positive outlooks by a ratio of 3 to 1.

Over the past year, the outlook balance has deteriorated in all global regions except Asia-Pacific. The deterioration was most pronounced in the Middle East, Commonwealth of Independent States (CIS) and Africa, while Europe has seen the strongest improvement among all regions in its outlook balance since 2011. At year-end 2015, there were three positive outlooks in the eurozone (Cyprus, Malta, Slovenia) and two negative ones (France and Finland).

For 2016, China appears to top the list of economic concerns. For Sovereigns and businesses that borrow internationally, Fed hike has seen financing costs increase through 2015. That said global oil prices appear likely to remain low in 2016, which will provide support for economic activity and trade accounts for the many oil importers in the region.

Sovereign downgrades likely to accelerate in 2016, suggests S&P's report

Thursday, January 21, 2016 11:13 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings