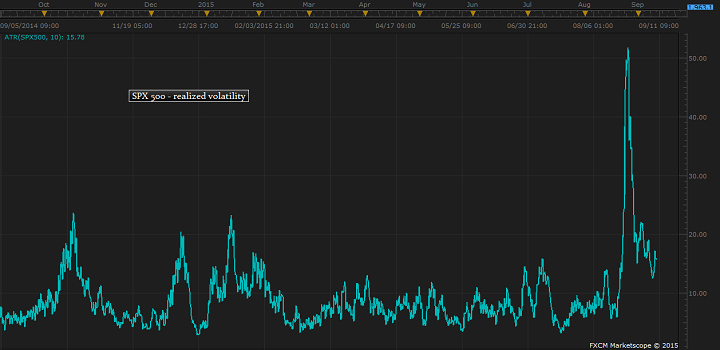

In spite of sharp drop yesterday, steady decline in realized volatility measured by 10 day Average True Range (ATR) suggests there could be further rise in S&P 500.

Focus now is on FOMC next Thursday. US stocks might extend gains, if FOMC participants prefer to wait for further evidence of strengthening US economy before raising rates.

While one rate hike seems unimportant as it is unlikely to increase borrowing cost by much, nevertheless it will indicate beginning of tightening cycle, which can't be deemed as unimportant.

- Last time FED began its tightening cycle back in 2004, rates turned out from 1% from 5.25% just in a span of two years.

- With yields higher, Equity investors are likely to demand much higher rate of return, which would be a fundamental blow to S&P 500.

- Equity valuations would be looking neither cheap nor attractive, once rate hike begins.

However, with inflation hovering much below 2%, FOMC participants are likely to remain divided in spite of lower unemployment rate, now at 5.1%.

After last night's sharp sell offs and continuation of that in Asian hours, S&P 500 future has recovered sharply, currently trading at 1951.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate