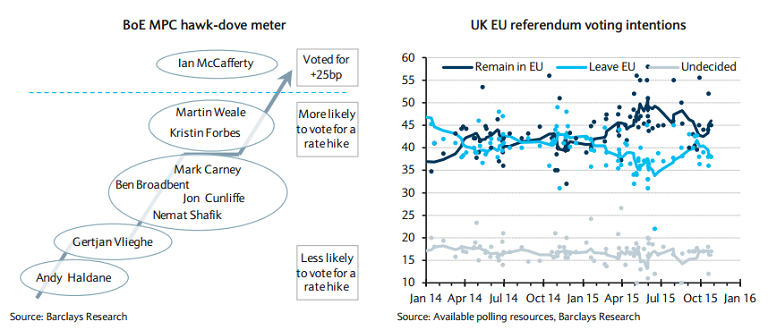

Market attention is now on the BoE's Quarterly Inflation Report, which will be released on "Super Thursday" along with a rate decision and the minutes from the latest monetary policy committee (MPC) meeting. The BoE is widely expected to leave policy settings unchanged, with Ian McCafferty likely to remain the sole dissenter, given his continued hawkish commentary since the October meeting. No changes are expected to the Bank's economic forecasts.

The BoE has repeatedly said it does not need to wait for the Fed before it raises rates. But many investors feel it would not risk going first. The Boe apart from considering the Fed's moves, will also be looking closely at domestic data, which suggest a period of rapid expansion might be ending. Dilemma of a relatively resilient domestic economy continues in which inflationary pressures, while weak, may well be on a rising path. A weakening external environment via a strong exchange rate, is also imparting considerable and persistent disinflationary/deflationary pressure on the economy.

Concern the UK could leave the European Union gives investors another reason to be edgy about the pound. On Thursday last week, Standard and Poor's warned the UK might face a downgrade of at least one notch in its AAA rating if it votes in a referendum to leave the EU, and two notches if relations between London and Brussels sour or that vote prompts secession from the UK by Scotland. Indeed, FX option markets continue to price very little risk premium, despite polls suggesting the gap between those wanting to exit the EU versus stay is close.

"The EU referendum is likely to be held in Sept. 2016 at the earliest, we believe, but the debate is already gaining momentum and as a result sterling could start to feel the impact if investor uncertainty towards UK assets starts to build," Morgan Stanley said in a note to its clients.

Data earlier today showed that UK manufacturing PMI for October rose to 55.5 from an upwardly revised 51.8 figure in September. PMI reading is the strongest in16 months and is fuelled by a jump in new orders to 56.9. This bodes well for output and employment in the sector and suggests that 4Q GDP growth should improve.

Sterling rose to six-week high against a trade-weighted basket of currencies on Friday, bolstered by expectations that British interest rates may rise faster than previously anticipated. Bid tone on the Sterling gathered pace today after the stellar UK data. GBP/JPY spiked to a high of 186.97, while GBP/USD hit session highs at 1.5497.

Sterling sidelined ahead of BoE "Super Thursday", dilemma continues

Monday, November 2, 2015 10:48 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand