Indian banks are seeing heavy deposit inflow driven by consumers' optimism as new government came to power last year and moving with their reform agenda to reverse India's ailing economy.

- New government launched Pradhan Mantri Jana dhan Yojna, which stands as a scheme to promote banking services to rural India to include more people under financial services by providing free life insurance if they open an account. Such scheme, along with stabilizing economy has attracted tons of deposits to Indian bank growing at rates between 12-15%. Public sector banks are enjoying largest chunk of deposit growth.

This means Indian banks are enjoying loads of cheap funds. However bank need to convert these deposits into loans without lending to subprime borrowers. Indian banks, especially the public-sector ones are being haunted by high level of non-performing assets.

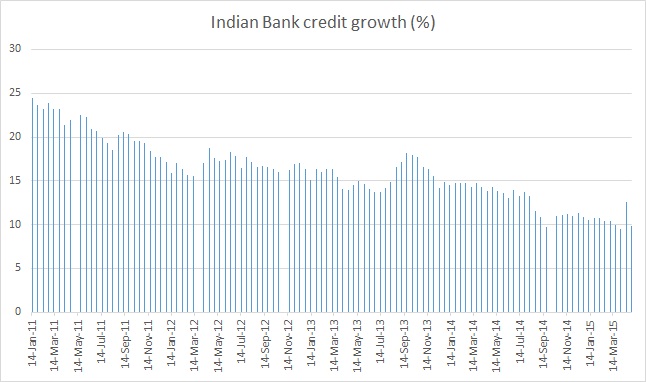

- Bank credit growth has remained subdued in comparison and has been lagging deposit growth for last few quarters now. This is a drag to bank's profitability as RBI has lowered deposit rates by 50 basis points this year.

- Credit growth in Indian banks are shown in chart. Latest reading was 9.8% and today RBI expected to release latest figure around 11:30 GMT.

Stronger credit growth and demand would push India higher on growth trajectory.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings