The Federal Reserve's recent rate hike decision caused the U.S. interest rate to be higher than global interest rate, and thereby the economy is receiving more capital inflows.

The economy recorded a marginal fall in net trade, which is mainly because of weaker global demand. If the expansionary monetary policy adopted by Europe, China, and Japan boosts the domestic demand, the U.S. will be a beneficiary. This is because, most of the global trades take place in USD only. Therefore, there is further scope for USD to increase.

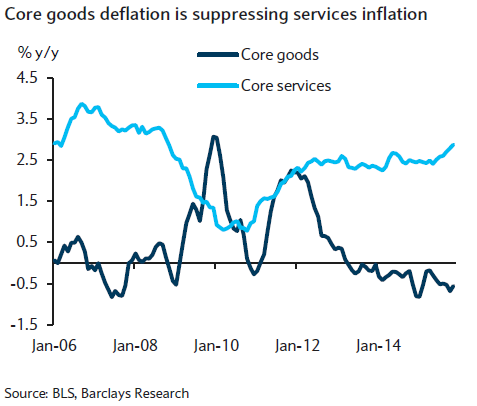

"We expect further pass-through from dollar appreciation to weigh on core goods prices through mid-2016. Renewed strength in the dollar since mid-year, particularly against EM currencies, and an accelerated decline in China PPI lead us to project a modest softening in core inflation in the months ahead - a factor which informs our believe that the Fed will execute three additional rate increases in 2016 instead of the expected four", says Barclays in a research note.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock